Octopus Apollo VCT

Offer closed

The Octopus Apollo VCT share offer is fully subscribed and closed as of 19 March 2024.

For VCTs you can invest in now, see current VCT offers.

If you have missed out, please register your interest below in the next Octopus Apollo VCT offer.

Register your interest – Octopus Apollo VCT

Octopus Apollo VCT is managed by the Octopus Ventures team, one of the largest and most successful venture capital teams in Europe.

Since 2018, it has focused on investing in small and medium-sized B2B software companies, which typically generate between £2 million and £8 million in annual revenue and have demonstrated strong revenue growth. The VCT currently has a portfolio of around 45 companies and net assets of £386 million (July 2023).

Over the five years to 31 December 2023, Octopus Apollo VCT generated a NAV total return (including dividends) of 52.5% – past performance is not a guide to the future.

- Seeking to raise up to £35 million with an overallotment facility of £15 million (in use as of 27 Feb 2024)

- Targets an annual dividend of 5% of NAV – variable and not guaranteed

- Minimum investment: £5,000

Important: The information on this website is for experienced investors. It is not a personal recommendation to invest. If you’re unsure, please seek advice. Investments are for the long term. They are high risk and illiquid and can fall as well as rise in value: you could lose all the money you invest.

Review: Octopus Apollo VCT

Below is our review of the most recent Octopus Apollo VCT share offer, which closed in March 2024 having raised £50 million including overallotment.

The manager

The VCT is managed by Octopus Ventures, part of Octopus Investments – the UK’s largest VCT manager, also responsible for Octopus Titan VCT, Octopus Future Generations VCT and the Octopus AIM VCTs.

Launched in 2000, today Octopus Investments has more than 680 employees and manages £13 billion (June 2023) on behalf of over 63,000 retail investors, charities and institutions, including pension funds, funds-of-funds and family offices.

The VCT is managed by Octopus Ventures’ B2B software team. Richard Court, the VCT’s Fund Manager, joined Octopus in 2017. He has been investing in UK and international SMEs since 2006 and has previously held a number of roles in investment banking and private equity. He is supported by a team of 13, as well as the wider resources of Octopus Ventures, including its dedicated Talent Team, focused on helping portfolio companies recruit and develop key staff.

Meet the manager: watch our video interview with Richard Court

Investment strategy

Octopus Apollo VCT launched in 2006 and in 2018 started to invest under the current growth capital investment strategy.

The team targets more commercialised businesses with a bias towards B2B software – usually steering clear of the startups favoured by stablemate Octopus Titan VCT. Apollo looks to help companies reach profitability, with its investments usually put towards increasing sales and marketing efforts, or expansion into new locations or markets.

At the point of investment, companies should have annual – preferably recurring – revenues exceeding £1 million, typically ranging between £2 million and £8 million. Businesses must have a proven proposition with evidence of significant revenue growth and a broad customer base.

Octopus Apollo typically invests £2 million to £10 million in each company via a mix of unsecured debt and equity.

Portfolio overview

Octopus Apollo VCT has net assets of £386 million (July 2023). The investment portfolio comprises around 45 companies with the majority of net assets now invested in B2B software growth capital deals. On average, the VCT top 10 holdings achieved revenue growth of 35% in 2022. The recurring, contracted revenue models have contributed to the portfolio companies’ resilience, somewhat insulating them from the headwinds many companies have faced in the last 18 months. As a result, the VCT is showing positive performance both in the medium and short term, where many of its peers have struggled.

The remaining portfolio is split between a mixture of cash, legacy, co-investments and quoted companies.

In the 12 months to July 2023, the VCT invested £56 million across five new and 12 follow-on investments. Since July, the VCT has invested a further £10.2 million into two new and two follow-on deals.

Asset type breakdown

Example portfolio companies

Natterbox – largest investment

Natterbox – largest investment

Established in 2010, Natterbox is a cloud-based telephony system that provides solutions to common call centre problems.

Natterbox removes the need for expensive IT and phone infrastructure, allowing businesses to easily scale without upgrading servers. The software can also integrate into most Client Relationship Management (CRM) programs, enabling automatic call capturing and information recording.

Octopus Apollo VCT first invested £5 million in March 2018 to support sales and product development.

The VCT has invested a total of £17.5 million; the holding was last valued at £36.3 million and accounts for 8.5% of the net assets of the VCT (July 2023). Past performance is not a guide to the future.

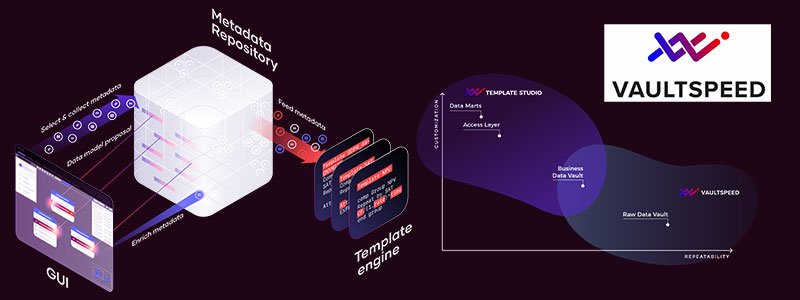

VaultSpeed – recent investment

VaultSpeed – recent investment

Masses of company data are increasingly moved to the cloud for faster analytics. However, without automation, it is near impossible for data teams to transform and integrate multi-source data on time, without compromising on quality or quantity.

VaultSpeed was set up to address this. It has built a powerful no-code platform that automates data transformation, helping businesses analyse, understand and store the data more easily and securely, saving time and resources.

VaultSpeed is already offering its solutions to global enterprises, particularly in finance, healthcare, and utilities sectors. The company has established strategic partnerships with Snowflake, Microsoft, and Databricks, and has developed a network of over 30 service partners to serve clients globally.

Octopus Ventures invested £6.5 million in October 2023, as a lead investor in a €15.1 million in Series A funding round. Other investors include Fortino Capital, PMV, and BNP Paribas Fortis Private Equity.

Exit track record

In the year to July 2023, Octopus Apollo VCT recorded three exits, resulting in proceeds of £13 million. Please note, past performance is not a guide to the future.

The Safeguarding Company – recent exit

The Safeguarding Company – recent exit

The Safeguarding Company has created safeguarding software, MyConcern, that makes it easier for caregivers to record, report and manage their concerns.

A big challenge for caregivers of children and vulnerable adults is sharing information that might help keep them safe. Each organisation that may be involved – police, schools, social services, and hospitals – all use different systems, so it is difficult and time-consuming for caregivers to create, maintain and update records. Information is easily lost or out of date, which can impact quality of care. MyConcern makes sharing data between agencies easy, enabling caregivers to spend more time caring for those in need.

The VCT initially backed the business in 2019 and invested a total of £4.9 million. The company was acquired in February 2023 by TES Global, a UK based international provider of digital solutions to schools. The deal provides the VCT with initial cash proceeds of £10.6 million, with the potential for additional proceeds to follow.

Spiralite – example of previous failure

As can be expected, not all investments worked out. One example is Spiralite.

Spiralite developed a patented air duct design for use in commercial property, believed to be more effective in terms of airflow and energy efficiency than rival solutions. However, the business struggled to gain the required commercial traction and, despite efforts to improve sales and external funding, the company was placed into administration in 2017 and the holding was written down to zero.

The investment had originally been made through Octopus Eclipse VCT and was inherited by Apollo when the two VCTs merged in 2016. The investment does not represent Apollo VCT’s own historic or current investment strategy.

Performance and dividends

Over the five years to 31 December 2023, Octopus Apollo VCT generated a NAV total return (including dividends) of 52.5% – past performance is not a guide to the future. Note, we show VCT returns over a five-year period as a minimum, where possible. Where a VCT has followed the same investment strategy for longer, we also show returns over 10 years.

There is a target annual dividend yield of 5% of Net Asset Value. Over the five years to December 2023 the VCT has paid total dividends per share of 16.3p, equivalent to a cumulative dividend yield of 35.1% of average starting NAV - dividends are variable and not guaranteed.

NAV and cumulative dividends per share over five years (p)

Dividend payments in the calendar year

Dividend yield history (% of starting NAV)

| Calendar year | Dividend as % of NAV |

|---|---|

| 2019 | 6.5% |

| 2020 | 5.3% |

| 2021 | 12.6% |

| 2022 | 5.0% |

| 2023 | 5.3% |

Source: Morningstar. Dividend yields are based on the dividends paid over the period divided by the starting NAV of the VCT in each period. Past performance is no guide to the future.

Dividend Reinvestment Scheme (DRIS)

There is a Dividend Reinvestment Scheme under which allows shareholders to reinvest future dividend payments by way of subscription for new shares, if desired. As these are new shares they should be eligible for tax relief (you will need to claim this on your tax return or directly with HMRC) and the shares will count towards the VCT annual subscription limit.

Share buybacks

The boards intend to buy back shares at up to a 5% discount to the prevailing net asset value. This is not guaranteed – please see the offer documents for details.

Discount history

VCT shares are traded on the London Stock Exchange. Similar to investment trusts, the share price can fluctuate and can be different from the VCT’s net asset value (NAV), i.e. the value of the VCT’s underlying investments. The difference between the share price of a VCT, and its net asset value per share, is called a discount.

Based on data from Morningstar, the discount to NAV as at 31 December 2023 was -6.92%. Over the previous five years the average discount to NAV was -6.46%.

The discount history is based on the closing share price of the VCT at the end of each month, divided by the latest net asset value at the time. Past performance is not a guide to the future. Investors looking to sell their VCT shares may get a better price using the VCTs’ share buyback facilities, although this is not guaranteed.

Risks – important

This, like all investments available through Wealth Club, is only for experienced investors happy to make their own investment decisions without advice.

VCTs are high-risk so should only form part of a balanced portfolio and you should not invest money you cannot afford to lose. They also tend to be illiquid and hard to sell and value. Before you invest, please carefully read the Risks and Commitments and the offer documents to ensure you fully understand the risks.

To retain the tax benefits, VCTs should be held for at least five years. If you sell VCT shares and reinvest in new shares of the same VCT (including any mergers) within six months, tax relief can be restricted. Tax rules can change and benefits depend on circumstances.

Charges and savings

A summary of the main charges and savings is shown below. The net initial charge shown includes the Wealth Club saving and any early bird discount. The investment may have additional charges and expenses: please see the provider documents including the Key Information Document for more details, offer price and share allotment calculation methodology.

Please note, capacity – for the offer or any early bird savings – can be reached early, and we may not be notified of this by the VCT in real time.

| Full initial charge | 5.5% |

| Early bird discount | — |

| Wealth Club initial saving | 2.5% |

| Existing investor discount | 1% |

| Net initial charge through Wealth Club (new investors) | 3% |

| Net initial charge through Wealth Club (existing investors) | 2% |

| Annual management charge | 2.5% |

| Annual administration charge | 0.3% |

| Performance fee | 20% |

| Annual rebate from Wealth Club | 0.10% |

More detail on the charges

Annual rebate

The offer includes an annual rebate for Wealth Club investors, payable for the first three years. This is a rebate of our renewal commission and should be equivalent to a percentage (shown in the table above) of the net asset value of the offer shares issued to you when you invest. Terms and conditions apply.

Deadlines

The offer is now fully subscribed.

Our view

Octopus Apollo VCT is the second largest VCT in the market.

The trust is managed by Octopus Ventures, which also manages Octopus Titan VCT, and has access to the same resources and enhanced deal flow.

From 2018, Apollo has focused on B2B software companies, targeting more mature, revenue-generating companies – a different but complementary focus to that of its stablemate Octopus Titan VCT.

This change appears to have been the making of the VCT.

Octopus Apollo now contains a portfolio of fast-growing software businesses. Its top 10 holdings delivered average revenue growth of 35% in 2022, and the VCT has experienced profitable exits from earlier growth capital investments, including The Safeguarding Company (mentioned above) and Veeqo, acquired by Amazon in 2021.

The VCT may be worth consideration for experienced investors seeking to complement a wider VCT investment portfolio.

How to invest

The most recent Octopus Apollo VCT offer was fully subscribed on 19 March 2024.

You can register your interest in the next offer.

Alternatively, see VCT offers available now.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.

The details

- Type

- Generalist

- Target dividend

- -

- Initial charge

- -

- Initial saving via Wealth Club

- -

- Net initial charge

- -

- Annual rebate

- -

- Funds raised / sought

- £50.0 million / £50.0 million

- Deadline

- CLOSED