The VCT-backed technology that can live-stream 3D from the ocean bed 6km deep

Archived article

Archived article: please remember tax and investment rules and circumstances can change over time. This article reflects our views at the time of publication.

The deepest part of the ocean floor, not including features like the Mariana Trench, lies six kilometres below sea level.

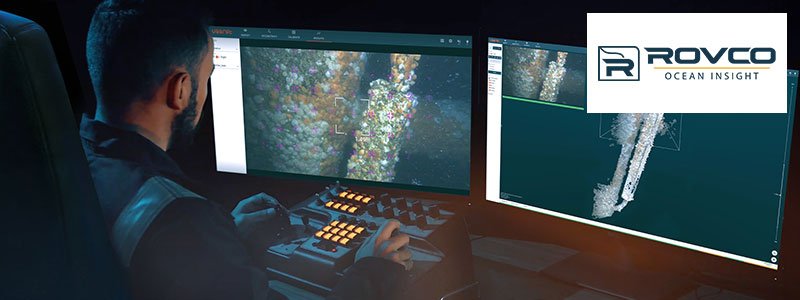

It is from this depth that marine-surveying company Rovco can live-stream ultra-precise 3D digital twins of structures and terrain, to devices anywhere in the world. Rovco believes it’s the world’s first technology to do so.

The Bristol-based young business is backed by Foresight Technology VCT. The VCT is a collaboration between alternative asset manager Foresight Group and WAE (formerly Williams Advanced Engineering), a specialist engineering business spun out from the Williams Formula 1 team.

Learn more about Rovco’s ground-breaking technology, why Foresight has invested £2.6 million to date, WAE’s engineering value-add – and how you can invest in the company and similar ones through Foresight Technology VCT.

Important: The information on this website is for experienced investors. It is not advice, research, nor a personal recommendation to invest. If you’re unsure, please seek advice. VCT investments are high risk and you could lose the money you invest.

More about Rovco

More about Rovco

The blue economy – the sustainable use of marine environments for economic growth and livelihoods – is estimated to be worth £3.2 trillion globally by 2030.

Many of its activities – for instance, building and maintaining offshore wind farms or decommissioning oil rigs – require underwater inspections and deep-sea data collecting.

Conventionally, this is done by teams that might spend months in the harsh conditions at sea. Using remotely-operated underwater vehicles (ROVs), they gather measurements and typically low-quality video feeds, to eventually take back to shore for analysis. Slow, expensive and highly labour-intensive, it’s been estimated a large, crewed vessel doing a deep-sea survey can cost up to £10 million a month.

To simplify and improve the process, Rovco has developed AI robotics that can gather far more precise data, and in a fraction of the time – saving project costs and human exposure to hazardous environments.

Established in 2015, the company designs and manufactures its own vessels and ROVs. Its ROVs are fitted with 3D computer vision technology, to capture high-definition data and live-stream it to any location.

The patented system collects a 3D cloud of individual data points and combines them with camera images to generate a realistic 3D reconstruction, a digital twin. It’s claimed to be the first underwater system to deliver this, with sub-millimetre precision, in real-time.

This is now used by Rovco’s clients in the energy and marine ecology industries. The technology enables engineers, researchers, salvagers and surveyors to de-risk and make better-informed decisions around their deepwater projects – without a wait of weeks or months, as with other inspection methods.

Rovco has developed all its hardware and software in-house and has filed three patent families covering various aspects of its technology. It is developing autonomous underwater vehicles (AUVs) to independently carry out subsea surveys – saving the cost of manually piloting ROVs.

Why did Foresight WAE Technology (FWT) invest in Rovco?

The Foresight WAE Technology (FWT) team is building a strong reputation as an experienced deeptech investor.

FWT first invested £2 million in Rovco in December 2019, via the Foresight WAE Technology EIS fund. In March 2022 it followed on with £600k, investing via the EIS fund and Foresight Technology VCT – FWT shares.

At the time of the initial investment, the company’s revenue was in the low millions; this has since grown nearly tenfold.

Foresight invested in Rovco for five key reasons:

- Disruptive and defensible technology – Rovco was well positioned to disrupt the subsea surveying market through its ability to gather and process data more quickly, safely and with higher levels of accuracy. The company has since built out its technology portfolio.

- Strong team with a roadmap to commercialisation – the founder and CEO, Brian Allen, is experienced in the sector and the company had already won several survey service contacts with major offshore wind operators. Brian has attracted a world class management team.

- Large addressable market – when FWT first invested, the market for surveys of offshore infrastructure using subsea robotics was estimated to be around $30 billion a year.

- The chance to offer FWT value-add – Rovco was keen to work with WAE to redesign its camera hardware and electronic systems, so they could operate at greater depths, with better thermal management and more processing power.

- ESG impact – Rovco’s advanced monitoring of sub-sea infrastructure, including wind farms, helps to improve their operation and reduce maintenance costs – supporting the transition to a low carbon energy system.

Rovco has developed technology offering game-changing improvements in an industry that really needs it. It is a large international market and Rovco has already generated early interest from some prominent customers, which hints at a substantial opportunity, and we are delighted to be able to support the team as they seek to capitalise. It is great to support another company which epitomises the spirit of the Foresight WAE collaboration.

Andrew Bloxam, Managing Director at Foresight

Want to invest in Rovco and similar companies through Foresight Technology VCT?

FWT is a share class in the Foresight Technology VCT (formerly Foresight Solar & Technology VCT). It focuses on early-stage, high-growth technology businesses.

Foresight and WAE have been working together since 2015. The VCT, launched in 2019, targets sectors where WAE can add significant value. Investors get exposure to a portfolio of 27 deep technology and advanced engineering businesses (June 2023).

The share class has net assets of £22.8 million (June 2023). In the three years to 31 December 2023, the VCT achieved a NAV total return of 3.6%. Past performance is not a guide to the future.

Foresight Technology VCT - FWT Shares: NAV and cumulative dividends per share over five years (p)

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.

Foresight Technology VCT – FWT shares

Learn more about Foresight Technology VCT – FWT shares – its manager, strategy, risks, what type of companies it invests in, the manager’s performance, charges and our view.

Read more and apply online