Haatch SEIS Fund

The Haatch SEIS fund is managed by the same team as the Haatch EIS funds: four successful entrepreneurs with first-hand experience of successfully founding, growing and selling businesses.

The fund invests in sectors the team knows well, such as software-as-a-service, on-demand, gig-economy and digital consumer and where the manager can use its considerable experience to add value. Haatch refers to this as its ‘Smart Money’ approach.

Haatch has made a total of 77 SEIS investments to date, including 65 through its SEIS funds. Of these, 18 are showing uplift in value (average 2.7x), 43 are held at cost and four have failed (May 2024). Past performance is not a guide to the future.

- Target return of 5x over five to 10 years – high risk and not guaranteed

- Planned deployment into a portfolio of 9-15 (minimum of 7) companies within 12 months of each tranche close - not guaranteed

- Minimum investment £10,000 – you can apply online

- Next deadline: 30 October for planned deployment in the 2024/25 tax year

Important: The information on this website is for experienced investors. It is not a personal recommendation to invest. If you’re unsure, please seek advice. Investments are for the long term. They are high risk and illiquid and can fall as well as rise in value: you could lose all the money you invest.

The manager

Haatch was founded by Scott Weavers-Wright and Fred Soneya. They met at Kiddicare.com, an online baby care retailer co-founded by Scott, which became one of the UK’s largest e-commerce businesses and was acquired by supermarket Morrisons for £70 million in 2011. Whilst at Kiddicare, Scott and Fred ran the Kiddicare start-up program, working with selected start-ups, three of which achieved exits in excess of $1 billion.

This experience led to an angel co-investment joint venture, Haatch Angel, in 2013 which in 2018 became Haatch Ventures.

Scott also founded retail cloud platform Elevaate in 2014, acquired four years later for $25.7 million, and in 2022 was awarded an OBE for services to Technology and Retail E-commerce Entrepreneurship.

Alongside Scott and Fred, the other partners at Haatch are Mark Bennett and Jonathan Keeling. Mark is Vice President Platforms and Devices Partnerships at Google. Previously, he led the international business for Google Play and was managing director of the music-streaming service Blinkbox Music, which he helped grow to 2.5 million users in 18 months. Jonathan joined Haatch in 2024 and was previously Chief Growth Officer at Crowdcube. As well as working at Haatch, Jonathan founded consultancy firm Edge Funding, which advises consumer startups on raising funds.

Partners have historically invested in every SEIS fund tranche.

In 2022, British Business Investments Ltd (BBI), a commercial subsidiary of the British Business Bank, made a £10 million commitment to Haatch through its £150 million Regional Angels Programme. The commitment is managed by Haatch and invested alongside the Haatch SEIS and EIS Funds. Haatch intends to deploy the British Business Investments’ funds alongside investors’ funds in every investment.

Before your subscription is invested, the cash will be held by the custodian, Mainspring Nominees Limited. After investment, shares will be held by the nominee, MNL Nominees Limited.

Meet the manager: Mark Bennett, partner at Haatch Ventures

Investment strategy

Haatch seeks to back entrepreneurs building disruptive digital businesses, particularly B2B software-as-a-service (SaaS) companies. This is where the team has significant experience and should be well placed to add value.

Each company is assessed against two key metrics: the problem it aims to solve, and the potential buyers.

The team seeks to back companies whose products it considers capable of becoming operationally essential to its customers and building natural levels of recurring revenues.

Haatch will also look at a company’s client acquisition plans, pricing strategies, and distribution channels to establish how well it understands its target market. While founders may be technically proficient, they are likely to need commercial support. Haatch will use its experience to advise on go-to-market strategy. Haatch believes its four partners complement each other and can provide portfolio companies with the support they need.

Haatch seeks to back promising founders before they have officially start to fundraise, so a significant proportion of deals are sourced from outbound enquiries and Haatch will be the first investor, typically leading funding rounds of £300,000 to £1 million. Haatch usually invests around £85,000 from British Business Investments alongside its SEIS fund investments.

The SEIS fund looks to back companies with 12-18 months of runway and potential for significant revenue growth (not guaranteed). The most promising businesses from the SEIS portfolio may receive follow-on investment from the Haatch EIS fund.

Where possible, Haatch reserves board rights, so any member of the investment team can attend portfolio companies’ board meetings.

Portfolio

The fund seeks to invest in a portfolio of at least seven, but usually 9-15 disruptive SEIS companies. Previous SEIS funds have averaged 12 investments each.

The companies outlined below are previous investments made by the Haatch Ventures SEIS Fund and give a flavour of the types of companies a new investor might expect.

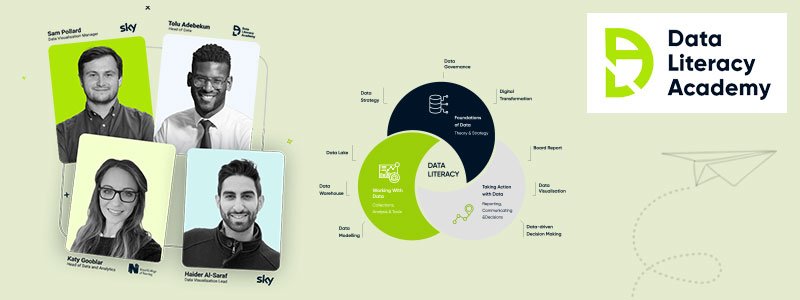

Data Literacy Academy

Data Literacy Academy

Businesses spend hundreds of billions of pounds each year on capturing, analysing, and storing data but the full value is often left unrealised. Only 11% of employees say they’re confident with their data literacy skills.

Data Literacy Academy was set up to address this. It has developed a learning platform providing clients and their employees with access to live and on-demand data literacy training. The company was founded by Greg Freeman, an entrepreneur who built several businesses from first sales to multi-million ARR, whom Haatch had previously worked with.

The business was pre-revenue when the SEIS fund invested £150,000 in November 2022. In the first quarter post-investment, the company attracted blue-chip clients such as carmaker Bentley and utility SSE, generating 70% of its year 1 revenue target in one quarter.

In October 2023, Haatch provided £480,000 follow-on funding via its EIS fund and BBI commitment. The SEIS investment is currently valued at 3.7x cost. Past performance is not a guide to the future.

Social Tip

Social Tip

Influencer marketing platform Social Tip launched in June 2024, founded by James Watt, the founder and former CEO of BrewDog.

The platform allows customers to earn cash rewards when they post about the brands they love on social media, e.g. Instagram or TikTok. The amount they receive is calculated by Social Tip’s algorithm to reflect the value of user engagement with the post. The goal is to engage and reward everyday customers, creating more authentic “word-of-mouth” marketing.

The company ran the fastest Crowdcube pre-registration campaign and has attracted several notable investors, including Dragon’s Den investor Stephen Bartlett and the founders of Minecraft developer 4J Studio, Chris van der Kuyl and Paddy Burn. Haatch invested the maximum £250,000 SEIS qualifying amount.

Example of previous exits

Haatch’s SEIS-qualifying investments, made through its EIS and SEIS funds, have yet to achieve a positive exit.

However, the team had a notable exit prior to launching the SEIS fund. In 2014, Haatch Angel made an SEIS-qualifying investment of £30,000 into Scott’s retail cloud platform business, Elevaate.

Elevaate grew to power supplier sponsorship programmes globally for several blue-chip clients. The business was acquired by US-based Quotient Technologies for $25.7 million in 2015. The original £30,000 investment generated a return of 276x (£8.3 million). Please note, this is an unusual exit example as the founder of Elevaate is also the founder of Haatch and past performance is not a guide to the future. The £30,000 invested acquired a large initial stake in the business and qualified for SEIS relief.

VuePay – example of previous failure

As with any SEIS company, these are high-risk investments and not all will work out as planned. VuePay is an example.

VuePay created a tool to enable content creators and influencers to monetise their content directly. Haatch invested in April 2020 alongside angel investors and supported the team to launch the minimum viable product. However, the business required a significant amount of capital to scale and the market for investment in consumer businesses quickly dried up. As a result, the investment has been written down to nil.

Performance

Haatch has backed a total of 77 SEIS-qualifying companies: 12 through its EIS funds and 65 through the SEIS fund, which launched in February 2021.

Of those backed in the SEIS fund, 18 are showing uplifts, averaging 2.7x cost, 43 are held at cost, and four have failed (May 2024). Past performance is not a guide to the future.

The chart below shows the average performance of the total subscribed into the funds each in each full tax year from 2013/14 (or from when the current strategy was adopted if later) to 2023/24. The chart is based on the latest valuations provided by the manager, expressed on a £100 invested basis. Please note, individual investor portfolios’ performance will deviate from the average.

Performance of SEIS-qualifying investments per £100 (12 companies)

Performance of Haatch Ventures: SEIS fund after launch per £100 invested (65 companies)

Source: Haatch Ventures, as at May 2024. Past performance is not a guide to future performance. The chart shows realised returns (where share proceeds have been returned to investors as cash) and unrealised returns (where cash has not yet been returned and the value of the investments is based on the manager’s own valuation methodology). There is no ready market for unlisted shares. The figures shown are net of all fees and do not include any income tax relief or loss relief. The performance figures refer to SEIS-qualifying investments made through the EIS fund until 2021/22 and SEIS fund performance thereafter to 2023/24.

Risks – important

This, like all investments available through Wealth Club, is only for experienced investors happy to make their own investment decisions without advice.

SEIS investments are high-risk and should only form part of a balanced portfolio. As must be expected with early-stage investments, some or even all of the companies in the portfolio could fail: the fewer the companies included in the portfolio, the higher the risk of loss if things don’t go to plan. You should not invest money you cannot afford to lose.

There is no ready market for unlisted SEIS shares: they are illiquid and hard to sell and value. There will need to be an exit for you to receive a realised return on your investment. Exits are likely to take considerably longer than the three-year minimum SEIS holding period; equally, an exit within three years could impact tax relief.

To claim tax relief, you will need SEIS3 certificates, normally issued once shares have been allotted. This can take several months: please check the deployment timescales carefully. Tax reliefs depend on the portfolio companies maintaining their SEIS-qualifying status. Remember, tax rules can change and benefits depend on circumstances.

Before you invest, please carefully read the Risks and Commitments and the offer documents to ensure you fully understand the risks.

Charges

The charging structure of this fund is different from that of most of its peers. There is an investor initial charge of 10% but there are no annual fees or on-going management charges – neither to investors nor investee companies. The manager believes this structure could be more beneficial in the long term. Please note: tax relief should be available on the amount invested, after deduction of the initial charge.

A summary of the main charges is shown below. The investment may have additional charges and expenses: please see the provider documents, including the Key Information Document, for more details.

| Investor charges | |

|---|---|

| Initial charge | 10% | Annual management charge | — |

| Administration charge | — |

| Dealing charge | — |

| Performance fee | 25–30% | Investee company charges |

| Initial charge | — | Annual charge | — |

More detail on the charges

Our view

The Haatch SEIS fund offers an opportunity to invest alongside a team of experienced entrepreneurs with first-hand experience of successfully founding, growing and selling businesses. The combination of mentoring from the Haatch team, a founder-friendly charging structure and the addition of British Business Investment money could make for an enticing prospect for entrepreneurs seeking SEIS funding and lead to enhanced deal flow (not guaranteed).

The fund is expected to build a portfolio of 9–15 companies to which the team believes it can add value, in sectors it knows well. Several of Haatch’s earlier SEIS investments now show promise: remember these are currently unrealised returns and past performance is not a guide to the future.

The offer could be a consideration for experienced investors looking to invest in a portfolio of SEIS companies alongside a team of experienced entrepreneurs.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.

The details

- Type

- Fund

- Sector

- Technology

- Target return

- 5x

- Funds raised / sought

- -

- Minimum investment

- £10,000

- Deadline

- 30 Oct for 2024/25 deployment