Mobeus VCTs

Share offer coming soon – Register your interest

In June 2024, the boards of the Mobeus VCTs announced their intention to merge Mobeus Income & Growth VCT with Mobeus Income & Growth 2, and The Income & Growth VCT with Mobeus Income & Growth 4.

As at 26 July the merger is now approved and the two continuing VCTs will open a new combined offer for subscription in September 2024. The offer seeks to raise up to £70 million, plus overallotment facilities of up to £20 million.

You can download the prospectus now from this page. You will be able to apply online here as soon as the offer opens on Monday 2 September.

Please register your interest below to receive free alerts when the Mobeus VCTs re-open for subscription.

Register your interest – Mobeus VCTs

The Mobeus VCTs – Mobeus Income & Growth VCT (MIG), Mobeus Income & Growth 2 VCT (MIG2), Mobeus Income & Growth 4 VCT (MIG4) and The Income & Growth VCT (I&G) – had net assets of £365.7 million and a portfolio of 41 companies as at 30 June 2022. All have the same investment remit and will generally invest in the same companies, albeit usually in different proportions.

In September 2021, Mobeus Equity Partners, the longstanding investment adviser to the Mobeus VCTs, announced its VCT management business had been acquired by Gresham House plc, the AIM-quoted asset manager that also manages the Baronsmead VCTs. The Mobeus VCTs’ investment team has transferred to Gresham House and the investment strategy remains unchanged.

The Mobeus VCTs have an impressive performance track record to date. They were the top four performing VCTs over both five and 10 years to September 2022. Over five years, they generated a NAV total return (including dividends reinvested) ranging from 74.8% (MIG2) to 105.1% (MIG), with the latter effectively doubling investors’ money. Past performance is not a guide to the future.

Important: The information on this website is for experienced investors. It is not a personal recommendation to invest. If you’re unsure, please seek advice. Investments are for the long term. They are high risk and illiquid and can fall as well as rise in value: you could lose all the money you invest.

Review – Mobeus VCTs

Below is our review of the Mobeus VCTs at the time of the last share offer in 2022.

This review will be updated when the new offer opens.

The manager

Mobeus Equity Partners, one of the UK’s most experienced VCT investment advisers, was historically responsible for the Mobeus VCTs.

In September 2021, Mobeus Equity Partners sold its VCT business to Gresham House plc, an AIM-quoted specialist alternative asset manager that also manages the Baronsmead VCTs. As part of the deal, the Mobeus VCT team, including partners Trevor Hope and Clive Austin, 14 staff and three consultants, transferred to Gresham House.

Trevor Hope and Clive Austin have joined Gresham House’s executive leadership team for both the Mobeus and Baronsmead VCTs and serve as Chief Investment Officer and Managing Director respectively. The VCT leadership team is supported by more than 40 people including 30 investment professionals. Together, they manage £795 million across the Mobeus and Baronsmead VCTs (Sep 2022).

Trevor Hope remains the lead manager on the Mobeus VCTs. This should ensure continuity in the way the Mobeus VCTs are managed and could provide opportunity, as it is expected that the two Baronsmead and four Mobeus VCTs will share unquoted deal flow.

Investment strategy

The four VCTs have the same investment remit and invest in the same companies, although in different proportions.

Like many VCT managers, Mobeus historically focused on providing capital to fund the management buyout (MBO) of larger (£10 million to £40 million turnover), established (10+ years) and profitable (£1 million to £3.5 million profit) companies. Virgin Wines is one example.

Since VCT rules changed in 2015, the focus has shifted towards younger companies across three stages of maturity:

- Early-stage businesses with revenues of around £500,000, expected to represent around 20% of new investments. These businesses will operate technology-led and disruptive business models.

- Mid-stage businesses generating £1+ million in revenues (expected to represent 60% of new investments). These businesses are likely to have proven unit economics and are seeking additional capital to grow sales and marketing, expand internationally, or continue product development.

- Late-stage, profitable businesses, expected to represent 20% of new investments.

Successful mid and late-stage investments may include follow-on funding rounds for successful businesses identified at an earlier stage.

The Mobeus VCTs have found success backing businesses that spin out from existing portfolio companies. These are businesses and teams the manager knows well, so it can invest at an early stage and progressively increase its stake. An example is Preservica, now the VCTs’ largest holding, detailed below.

Portfolio overview

The VCTs’ portfolios include around 41 companies, currently valued at £365.7 million (June 2022). Of these, 19 are legacy investments and 22 are growth capital companies. The VCTs offer exposure to a diverse range of sectors, although technology-enabled investments are preferred – software and computer services represent the largest sector concentration at c.41%.

Following recent exits, 48.3% of the combined Mobeus portfolio is invested in post-2015 growth capital investments. Pre-2015 investments account for 16.5% (June 2022). The remainder is held in cash and other liquid assets.

Combined portfolio sector breakdown (%)

Examples of portfolio companies

Preservica – largest holding

Preservica – largest holding

Preservica was spun out of a previous Mobeus investment, Tessella, in 2015, with Mobeus initially investing £3 million. The company had developed a digital preservation system in partnership with the National Archives to store crucial digital data and documents.

Effective storage for digital data is increasingly important as both the quantity of digital data produced increases and the speed of innovation renders old formats obsolete. That presents a challenge when data might need to be stored and accessed years later to protect intellectual property, meet regulatory requirements or preserve documents of cultural or academic significance.

Preservica continues to grow strongly and now works with four of the UK’s 10 largest businesses and 26 US State Archives, and more than 350 customers across more than 20 countries worldwide.

Mobeus has steadily supported that growth, investing a total of £15 million. The overall holding is now valued at £47.2 million and represents the largest growth capital investment across the four VCTs combined. Past performance is not a guide to the future.

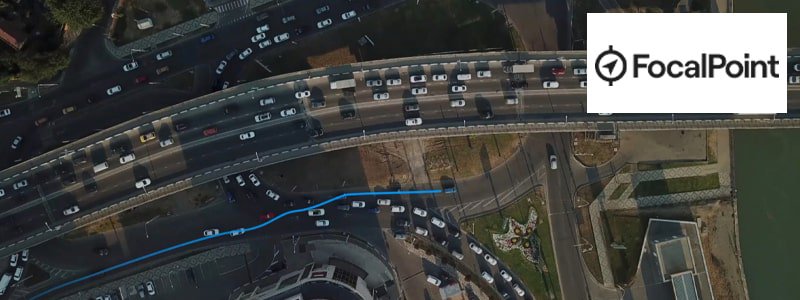

FocalPoint Positioning – recent investment

FocalPoint Positioning – recent investment

Founded in 2015 by Dr. Ramsey Faragher, FocalPoint Positioning aims to significantly improve the accuracy of positioning data for smartphones and autonomous platforms, indoors and out.

It is claimed over $1 trillion of the US economy, and €800 billion of the European economy depends on the Global Navigation Satellite System. Despite this, FocalPoint believes the accuracy of current receivers is a long way from where it needs to be.

FocalPoint believes its technology is up to 10x more accurate in urban areas and can significantly lower battery usage. The technology has several use cases including sports wearables, pedestrian navigation, and asset tracking.

The Mobeus VCTs initially invested £2.2 million in September 2022 as part of a larger $17 million funding round supported by existing investor Molten Ventures.

Exit track record

In the five years to June 2022 the Mobeus VCTs achieved 19 full and three partial exits, generating total proceeds of £282.2 million and a total gain of £175.8 million. Note, past performance is not a guide to the future and there have also been failures.

Media Business Insight – recent exit

Media Business Insight – recent exit

Media Business Insight is a leading content, insight and events business for the creative media industry. It owns a collection of news, intelligence and information brands focused on the media and marketing sectors. Examples include Broadcast Intelligence, which provides data on 500+ broadcast commissioners, individuals responsible for deciding which shows get made and when they are broadcast.

Mobeus originally invested £11.7 million in January 2015 to support the management buyout from Ascential Plc. The investment enabled the business to transition from traditional publisher to a digital-led data, insights and intelligence company.

In June 2022, the company was acquired by GlobalData Plc, the £1.2 billion market capitalisation AIM-quoted data conglomerate. The exit generated a 2.2x return for the Mobeus VCTs. Past performance is not a guide to the future.

SuperCarers – previous failure

As is inevitable with early-stage investing, not all investments work out. SuperCarers is an example.

SuperCarers provided an online platform connecting people seeking home care, typically for their elderly relatives, with experienced independent carers. Carers and care-seekers managed care directly, thus reducing the administrative burden and the need for care managers, enabling care to be delivered with greater flexibility and more cost-effectively.

Mobeus invested around £2.1 million across all four VCTs, in March 2018. By 2019, the business was undertaking a restructure of its cost base after falling well behind plan and Mobeus wrote down the value of the holding accordingly. In July 2020, the business entered voluntary liquidation and the value of the business was written down to nil.

Performance and dividends

The four Mobeus VCTs were the top performing VCTs over both five and 10 years to September 2022.

Over five years to September 2022 the VCTs generated a NAV total return ranging from 74.8% (MIG2) to 105.1% (MIG). This has been driven by significant uplifts in value for several key holdings including Preservica, now the VCTs’ largest holding, as well as profitable exits such as Virgin Wines, MPB and Red Paddle.

Over the longer term the VCTs have generated a NAV total return (including dividends reinvested) ranging from 179.8% (MIG4) to 251.1% (MIG) in the ten years to September 2022.

The VCTs target dividends of 4-6p per share per year. Over the 10 years to September 2022, the Mobeus VCTs have paid cumulative dividends ranging from 115p to 120p per share. That is equivalent to a dividend yield of 114.8%–142.27% of average NAV in the period. Dividends are variable and not guaranteed. Past performance is not a guide to the future. Note, we show VCT returns over a five-year period as a minimum, where possible. Where a VCT has followed the same investment strategy for longer, we also show returns over 10 years.

NAV and cumulative dividends per share over five years (p)

Dividend payments in the calendar year

Average dividend yield (% of NAV) history

| I&G | MIG | MIG2 | MIG4 | |

|---|---|---|---|---|

| 2017 | 24.4% | 24.3% | 24.2% | 28.6% |

| 2018 | 7.0% | 7.2% | 0.0% | 4.7% |

| 2019 | 12.1% | 25.5% | 20.7% | 21.6% |

| 2020 | 19.0% | 18.0% | 22.7% | 8.7% |

| 2021 | 9.6% | 11.3% | 18.0% | 9.2% |

| YTD | 4.2% | 5.0% | 0.0% | 4.1% |

Dividend Investment Scheme

Mobeus Income & Growth 4 VCT and The Income & Growth VCT operate a dividend investment scheme that allows shareholders to reinvest future cash dividend payments in new shares if desired. As these are new shares they should be eligible for tax relief (you will need to claim this on your tax return or directly with HMRC) and the shares will count towards the VCT annual subscription limit.

Share buyback policy

The board of each VCT intends to buy back shares to maintain shares at up to a 5% discount to the prevailing net asset value. This is not guaranteed – please see the offer documents for details.

Discount history

VCT shares are traded on the London Stock Exchange. Similar to investment trusts, the share price can fluctuate and can be different from the VCT’s net asset value (NAV), i.e. the value of the VCT’s underlying investments. The difference between the share price of a VCT, and its net asset value per share, is called a discount.

Based on data from Morningstar, the average discount to NAV as at 30 June 2023 was -6.35%. Over the previous five years the average discount to NAV was -9.13%.

The discount history is based on the closing share price of the VCTs at the end of each month, divided by the latest net asset value at the time. Past performance is not a guide to the future. Investors looking to sell their VCT shares may get a better price using the VCTs’ share buyback facilities, although this is not guaranteed.

Risks – important

This, like all investments available through Wealth Club, is only for experienced investors happy to make their own investment decisions without advice.

VCTs are high-risk so should only form part of a balanced portfolio and you should not invest money you cannot afford to lose. They also tend to be illiquid and hard to sell and value. Before you invest, please carefully read the Risks and Commitments and the offer documents to ensure you fully understand the risks.

To retain the tax benefits, VCTs should be held for at least five years. If you sell VCT shares and reinvest in new shares of the same VCT (including any mergers) within six months, tax relief can be restricted. Tax rules can change and benefits depend on circumstances.

Charges and savings

A summary of the main charges and savings is shown below. The net initial charge shown includes the Wealth Club saving and any early bird discount. The investment may have additional charges and expenses: please see the provider documents including the Key Information Document for more details, offer price and share allotment calculation methodology.

Please note, capacity – for the offer or any early bird savings – can be reached early, and we may not be notified of this by the VCT in real time.

| Full initial charge | 3% |

| Early bird discount | — |

| Wealth Club initial saving | 0.5% |

| Existing shareholder discount | — |

| Net initial charge through Wealth Club (new investors) | 2.5% |

| Net initial charge through Wealth Club (existing investors) | 2.5% |

| Annual management charge | 2–2.4% |

| Annual administration charge | See offer documents |

| Performance fee | 15–20% |

| Annual rebate from Wealth Club (for three years) | 0.10% |

More detail on the charges

Annual rebate when you invest through Wealth Club

The Mobeus VCTs include an annual rebate for Wealth Club investors, payable for the first three years.

This is a rebate of our renewal commission and should be equivalent to a percentage (shown in the table above) of the Net Asset Value of the Offer Shares issued to you when you invest. Terms and conditions apply.

Our view

Since 2015 the VCTs have been transitioning towards growth investments: now just 16.5% of the portfolio is held within MBO investments. During this time, the VCTs have maintained their enviable track record. The four VCTs were the top performing VCTs over both five and ten years to September 2022.

Many areas of the portfolio have contributed strongly to performance during the transition, such as MBO deals Red Paddle and Virgin Wines, and growth capital deal Preservica. Past performance is not a guide to the future.

The core Mobeus team is highly experienced. The VCTs’ acquisition by Gresham House is not expected to change its tried and tested investment approach.

Longer-term, shared deal flow between the Mobeus and Baronsmead VCTs – and access to wider Gresham House resources – could be a positive in our view, potentially improving the VCTs’ access to companies and management teams. This, together with a strong and experienced management team and well diversified portfolio, makes the Mobeus VCTs a quality offer for consideration.

How to invest

The Mobeus VCTs have published a combined prospectus for the mergers and for a new share offer in 2024/25.

Download the prospectus below and register your interest here – you will receive free VCT alerts, and will be able to apply online here when the offer opens.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.

The details

- Type

- Generalist

- Target dividend

- -

- Initial charge

- -

- Initial saving via Wealth Club

- -

- Net initial charge

- -

- Annual rebate

- -

- Funds raised / sought

- £70.0 million sought

- Deadline

- Coming soon