How to claim VCT tax relief

When you invest in VCTs, you can receive up to 30% income tax relief plus tax-free dividends.

You don’t need to declare any tax-free dividends you receive. But how do you go about claiming the income tax relief in practice?

Below we give a simple step-by-step guide, which you can use as a starting point, although it is not tax advice nor a personal recommendation. Tax rules change and benefits depend on circumstances. If you’re in doubt, you may want to seek advice from an accountant.

What you need to have on hand to claim VCT tax relief

Soon after your VCT shares are allotted, you will receive a VCT share certificate and a VCT tax certificate.

You will need the share certificate if you wish to sell your VCT shares (usually possible after 5 years to retain the tax relief). You will need the tax certificate to claim your VCT tax relief.

The process you follow will depend on whether or not you submit your tax return and how (by post or online). It will also depend to an extent on when in the tax year your shares are allotted. The information below is current as per the 2022/23 tax year.

- How to claim VCT tax relief on your paper tax return

- How to claim VCT tax relief in your online self-assessment form

- How to claim VCT tax relief through an adjustment of your tax code

- How you could claim VCT tax relief if you’re self-employed

- How to claim VCT tax relief if you don’t file a tax return

How to claim VCT tax relief on your paper tax return

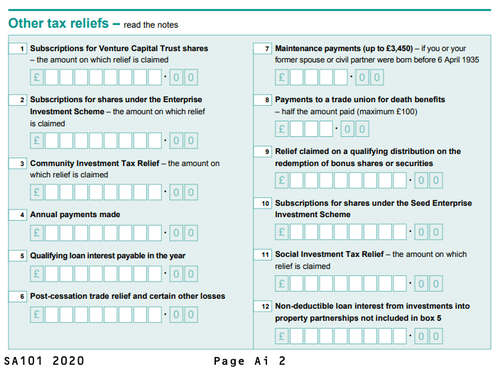

- You will need to complete the “Additional information” sheet (form SA101) and enclose it with your return.

- Go to the “Other tax reliefs” section, on page Ai 2

- In box 1 (“Subscriptions for Venture Capital Trust shares”), please write the total amount of all your VCT subscriptions on which you wish to claim tax relief.

Please note, HMRC doesn’t require you to submit your tax certificates for the VCTs on which you are claiming tax relief. It could, however, ask you to produce them later, so please ensure you keep them safe.

Tax relief claimed via your tax return will reduce the amount of tax you will have to pay. If you have already paid too much income tax, the excess can either be repaid by cheque or directly into your bank account.

How to claim VCT tax relief in your online self-assessment form

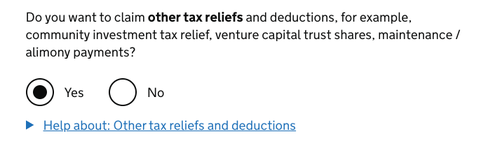

- In section 3, “Tailor your return”, you will need to answer “Yes” to the question on other tax reliefs

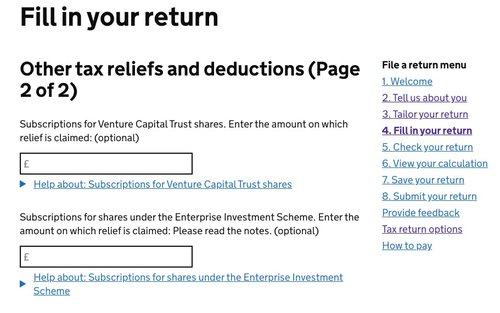

- Then in section 4, “Fill in your return”, there is a subsection “Other tax relief and deductions”. Type in the total amount of all your VCT subscriptions on which you wish to claim tax relief.

Please note, HMRC doesn’t require you to send your tax certificates for the VCTs on which you are claiming tax relief. It could, however, ask you to produce them later, so please ensure you keep them safe.

Tax relief claimed via your tax return will reduce the amount of tax you will have to pay. If you have already paid too much income tax, the excess can either be repaid by cheque or directly into your bank account.

How to claim VCT tax relief through an adjustment of your tax code

If you have invested early in the tax year, and pay tax at source through PAYE, you may want to claim VCT tax relief through an adjustment of your tax code. This means that, instead of getting the tax relief after filing your return, the income tax you pay each month will be reduced until all the tax relief has been used up.

If this is of interest, you should write to HMRC asking for the adjustment. You should include your national insurance number, a P60 form and a copy of your VCT tax certificate.

It may take around a month or more for the change to be effective.

How you could claim VCT tax relief if you’re self-employed

If you’re self-employed, you could consider reducing your payments on account, to reflect the tax relief to which you should be entitled.

For instance, if you estimate your total tax bill for the tax year will be lower than your payments on account, once you take VCT tax relief into consideration, you could complete form SA303 to reduce your payments. The form is available on the HMRC website.

You may not necessarily want to do this unless you’re confident your calculations are accurate. If you reduce your payments on account below the correct level, you will be charged interest.

How to claim VCT tax relief if you don’t file a tax return

If you don’t habitually file a tax return – for instance, if all of your tax is paid at source through PAYE – there is an alternative way to claim VCT tax relief.

You can send your VCT tax certificate, along with a copy of your P60 (if you have one), to HMRC.

You should then either receive tax relief by way of a PAYE code change, or a tax refund.

As mentioned above, this is not tax advice. If you are not sure about how to claim VCT tax relief please consult HMRC’s full guidance on the subject or speak to your accountant.