Octopus Ventures EIS Service

Offer closed

As at 21 July 2023, the Octopus Ventures EIS Service is closed.

Please see our other EIS offers that are currently open.

Alternatively, to be notified when the fund next opens please register your interest below.

Register your interest – Octopus Ventures EIS Service

Best known for managing Octopus Titan VCT, Octopus Ventures is one of the UK’s leading venture capital teams, and one of the largest in Europe.

It invests in some of the UK’s fastest-growing private technology companies. Its VCT track record includes backing four companies that have achieved ‘unicorn’ status (a valuation of $1+ billion) and achieving several high-profile exits with trade sales to the likes of Microsoft, Twitter and Amazon.

Octopus Ventures launched its EIS service, Octopus Ventures EIS Service, in November 2020, to follow the same investment strategy as – and co-invest alongside – Octopus Titan VCT, the UK’s largest Venture Capital Trust. Since then, Octopus Ventures has raised £77 million across its EIS funds, investing into 53 companies to date (December 2022).

- Target return 10x on the initial investment, not guaranteed

- Deployment into a target portfolio of around 10-15 companies, expected to take 6-12 months – not guaranteed

Important: The information on this website is for experienced investors. It is not a personal recommendation to invest. If you’re unsure, please seek advice. Investments are for the long term. They are high risk and illiquid and can fall as well as rise in value: you could lose all the money you invest.

The manager

The Fund is managed by Octopus Ventures, part of Octopus Investments. The Group was launched in 2000 and today has over 750 employees and manages £12.8 billion (December 2022) on behalf of over 63,000 retail investors, charities and institutions, including pension funds, fund-of-funds and family offices.

Octopus Ventures manages a total of over £2.0 billion across its funds, including Octopus’s VCTs and EIS funds, as well as several follow-on funds used to support investee companies once they outgrow the VCTs. Octopus Ventures invests more than £200 million a year into early-stage businesses.

The 90-strong Octopus Ventures team – expanded from 65 in the year to June 2022 – is one of Europe’s largest early-stage investment teams, and a destination for early-stage entrepreneurs seeking funding.

Alongside investment professionals, it also includes a talent team dedicated to helping portfolio companies hire the best people, as well as legal, operational, and administrative support. Before joining Octopus, many of the team were well-established in other industries, such as consumer goods, professional services, and technology.

Most of the team is based in London, but there has been a New York office since 2016, giving Octopus an international presence and facilitating the expansion of portfolio companies in the US. The wider Octopus Ventures network spans from San Francisco to China.

Meet the manager: Watch a video interview with Simon King of Octopus Ventures:

Investment strategy

The Octopus Ventures EIS Service follows the same investment strategy as Octopus Titan VCT, co-investing alongside the VCT on new investments, as well as selected follow-on opportunities.

The Fund aims to invest in high-growth early-stage companies, which are developing innovative technologies and operating in large and fast-growing markets. The team only considers making investments into businesses it believes can deliver returns of 10x on the initial investment (although the target return is lower for follow-on investments). Note, alongside the high expected return, the team also expects some of the investments to fail as these are high-risk businesses.

The EIS Service will invest across five broad investment themes, defined by Octopus Ventures as fintech, health, deep tech, consumer, and B2B software. Each theme is overseen by a dedicated “pod” within the Octopus Ventures team. This helps maintain focus on each theme as the team and its assets under management grow.

The quality of the investee company’s management team remains the most important driver of investment decisions. Octopus looks for talented entrepreneurs and management teams, with whom it can build long-term and mutually beneficial relationships.

As an example, in 2003 the investment team that would later become Octopus Ventures backed three entrepreneurs – William Reeve, Graham Bosher and Alex Chesterman – who were founders of an online DVD company that later became LoveFilm (acquired by Amazon for nearly £200 million in 2011).

Since then, Octopus has supported the same three entrepreneurs through five ventures. Mr Reeve was on the early board of Secret Escapes. Mr Bosher was behind Graze.com and Tails.com. Mr Chesterman went on to start Zoopla, Octopus Titan VCT’s first unicorn (a start-up that achieves a $1 billion valuation), then used-car supermarket Cazoo, which set the record for the fastest UK company to achieve unicorn status and later floated on NASDAQ.

Due to its size and position in the market, the Octopus Ventures team engages with thousands of businesses every year. From these, it expects to make 20-30 new early-stage investments per year. Octopus expects to hold investments for five to 10 years.

Portfolio

Investors in the Octopus Ventures EIS Service can expect exposure to around 10-15 investee companies comprising both new and follow-on investments (not guaranteed). Whilst Octopus Ventures seeks to build a diversified portfolio for investors, there are no specific asset allocation targets for new or follow-on investments, nor sector or theme allocations.

To date, the EIS Service and Knowledge Intensive funds have invested in 53 companies in total.

The companies outlined below are previous investments made by the EIS Service but are unlikely to form part of a new investor’s portfolio. They are outlined to give examples of the types of companies an investor might expect.

Papercup – recent investment

Papercup – recent investment

Millions of hours of video and audio content is produced every year – from news reports and films to YouTube and podcasts. Just 1% of that is dubbed into more than one language, partly because of the cost of translation services.

Papercup has developed an AI which can transcribe, translate and create a human sounding voiceover, all automatically. That has the potential to vastly reduce the cost of dubbing content, not only attracting existing dubbing customers, but potentially dramatically increasing the size of in the industry by making dubbing available to new content creators and owners.

The company has now raised $30.5 million from investors, including the venture arms of major media groups like Sky and the Guardian. Octopus first invested as part of a $20 million Series A round announced in June 2022.

Bondaval – recent investment

Bondaval – recent investment

Inventory financing can be complicated and lengthy for independent retailers: tying up their working capital and putting them at a disadvantage compared to larger corporates.

Insurance technology company BondAval was set up in 2020 to address this and disrupt the $2.5 trillion global trade credit insurance market by helping independent retailers access better credit terms while providing assurance to suppliers they will be paid on time.

BondAval has developed a new form of investment-grade B2B payment security: MicroBonds. Unlike traditional bank guarantees and collateral-based instruments, which can take months to secure, MicroBonds use a credit risk engine, don’t require collateral and are available almost instantly online and are backed by a leading insurer.

In January 2021, the business received $1.64 million in early backing from a host of angel and venture capital investors. In October 2021, Octopus Ventures led a $7 million investment round alongside US-based venture investor Expa, founded by Uber co-founder Garrett Camp. Expa will work with BondAval to develop its business in the US and around the world.

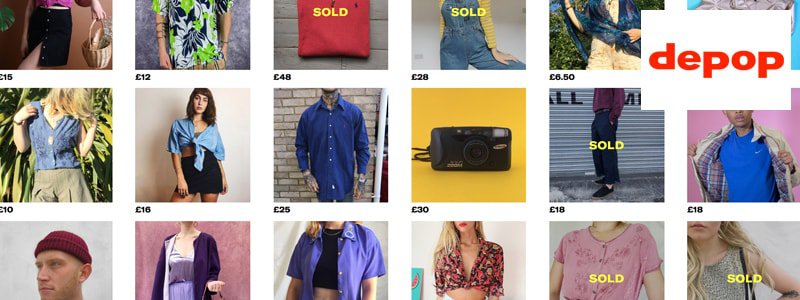

Depop – example of recent exit

Depop – example of recent exit

The Octopus Ventures EIS service launched in November 2020, so is yet to experience any exits. However, one recent exit example from the Octopus Ventures team is Depop.

Founded in 2011, Depop began life as a social network that enabled readers of PIG (People in Groove) magazine to buy items from the young designers featured in the magazine. It has since developed into an online fashion marketplace in which users can buy, sell and discover unique fashion. By 2021, the business was reported to have over 30 million users globally, 90% of which are under the age of 26.

Octopus Ventures invested through Octopus Titan VCT: first, £5 million in January 2018 at a £52 million post-money valuation, then £3.77 million follow-on funding in 2019. In June 2021, Depop was acquired by Etsy Inc. for $1.63 billion, generating proceeds of £97.4 million for the VCT, an 11.1x realised return. Past performance is not a guide to the future.

Mush – example of previous failure

As is to be expected, not all investments work out. Mush is one example. After experiencing first-hand the difficulties of coping with newborn babies, the founders created Mush, a social app for mums to meet up with other mums in their local area.

Octopus Ventures invested £1.5 million into the business through Octopus Titan VCT in January 2018, as part of a £2 million investment round. At the time, the app had been downloaded by 300,000 mums in both UK and Australia. However, after the investment, the business was unable to generate the level of growth required to attract future funding and was eventually acquired by Mumsnet Inc in September 2021. The VCT received a nominal consideration for its stake in the business.

What are the main differences between Octopus Titan VCT and Octopus Ventures EIS Service?

VCTs and EIS have different structures and tax reliefs. Please note, the Octopus Titan VCT is not currently open for investment.

An investor in Octopus Titan VCT buys shares in the VCT, and has exposure to the VCT's whole portfolio – a combination of older and new investments. The VCT is expected to generate some of its returns via tax-free dividends, not guaranteed.

When investing in the Octopus Ventures EIS Service, an investor gets exposure to a much smaller (15-25) number of companies, which will receive investment after the tranche closes. The investor buys shares in the portfolio companies directly and those companies will all be early stage (rather than the mix of early and later stage businesses found in the VCT). Portfolios are likely to be different, depending on the tranche.

This means the EIS portfolio is much more concentrated: any individual failures, as well as any individual successes, will have a greater impact on the portfolio than they do within the VCT. EIS returns also tend to come in the form of exit only and, unlike a VCT, there is no secondary market for EIS shares. Put another way, with the EIS there is more risk of losing money, but the potential rewards could be greater and the available tax relief more generous: tax benefits can change and benefits depend on circumstances.

Performance

Octopus has a reputation for backing some of the UK’s fastest growing private technology companies – four of the companies backed by the Octopus Titan VCT have become unicorns.

However, the EIS Service is far younger than the VCT and don’t yet have a five-year track record. The two have so far invested into 53 EIS-qualifying companies and have yet to achieve any exits.

The chart below shows the average performance of the total subscribed into the funds in each full tax year from 2012/13 (or from when the current strategy was adopted if later) to 2021/22. The chart is based on the latest valuations provided by the manager, expressed on a £100 invested basis. Please note, individual investor portfolios’ performance will deviate from the average.

Performance of Octopus Ventures EIS funds per £100 invested in each tax year

Source: Octopus Ventures, as at 30 November 2022. Past performance is not a guide to future performance. The chart shows realised returns (where share proceeds have been returned to investors as cash) and unrealised returns (where cash has not yet been returned and the value of the investments is based on the manager’s own valuation methodology). There is no ready market for unlisted shares. The figures shown are net of all fees and do not include any income tax relief or loss relief.

Risks – important

This, like all investments available through Wealth Club, is only for experienced investors happy to make their own investment decisions without advice.

EIS investments are high-risk and should only form part of a balanced portfolio. As must be expected with early-stage investments, some or even all of the companies in the portfolio could fail: the fewer the companies included in the portfolio, the higher the risk of loss if things don’t go to plan. You should not invest money you cannot afford to lose.

There is no ready market for unlisted EIS shares: they are illiquid and hard to sell and value. There will need to be an “exit” for you to receive a realised return on your investment. Exits are likely to take considerably longer than the three-year minimum EIS holding period; equally, an exit within three years could impact tax relief.

To claim tax relief, you will need EIS3 certificates, normally issued once shares have been allotted. This can take several months: please check the deployment timescales carefully. Tax reliefs depend on the portfolio companies maintaining their EIS-qualifying status. Remember, tax rules can change and benefits depend on circumstances.

Before you invest, please carefully read the Risks and Commitments and the offer documents to ensure you fully understand the risks.

Charges

A summary of the main charges and savings is shown below.

To align interests with those of investors, Octopus collects its annual management charge (AMC) when a profitable exit happens. Please note, this is applied on a per-company basis so if some companies succeed and others fail, fees may be payable, despite the portfolio losing money in aggregate.

The performance fee should be an incentive to maximise value for investors on any exit. Exits could take five years or more and are not guaranteed.

The investment may have additional charges and expenses: please see the provider documents, including the Key Information Document, for more details.

| Investor charges | |

|---|---|

| Full initial charge | 4% |

| Wealth Club initial saving | — |

| Net initial charge through Wealth Club | 4% | Annual management charge | 2% |

| Administration charge | — |

| Dealing charge | 1% |

| Performance fee | 20% | Investee company charges |

| Initial charge | — |

| Annual management charges | — |

More detail on the charges

Our view

The Octopus Ventures EIS Service is managed by a Ventures team which has a long track record of backing some of the UK’s fastest-growing private technology companies.

Investors in the Fund benefit from the scale of Octopus Ventures, a team of 90, which now manages more than £2.0 billion.

The team is well structured around five specialist “pods” or sub-teams, each covering a specific sector. This should facilitate the deployment of increasing amounts of capital whilst maintaining the quality of its investment approach and meeting the challenge of identifying some of the most promising companies. Moreover, the scale of Octopus Ventures is likely to attract enhanced deal flow compared with other EIS offers.

The Fund comes with a success-based charging structure: the annual management charge with respect to each investee company (not the whole portfolio) only becomes payable if and when a profitable exit is achieved.

The exposure to high-growth companies may appeal to wealthy investors seeking to complement a wider investment portfolio. The familiarity and similarity to Octopus Titan VCT may also appeal to experienced VCT investors considering more concentrated and higher-risk EIS investments.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.

The details

- Type

- Fund

- Sector

- Technology

- Target return

- -

- Funds raised / sought

- -

- Minimum investment

- -

- Deadline

- CLOSED