Par Knowledge Intensive EIS Fund II

Offer closed

As at 4 April 2024 (5pm), Par Knowledge Intensive EIS Fund II is closed.

Please see our other EIS offers that are currently open.

Alternatively, to be notified when the fund next opens please register your interest below.

Register your interest – Par Knowledge Intensive EIS Fund II

The Par Knowledge Intensive (KI) EIS Fund invests in technology growth companies predominantly in Scotland, Northern Ireland and the north of England. Par Equity (Par) focuses on technology companies with defensible intellectual property and an initial track record of sales, targeting companies in the “equity gap” of firms too large for business angels but too small for most private equity investors.

The Par Investor Network, a group of c.200 experienced business angels, contribute new deal flow, help with due diligence, provide guidance and experience to investee companies and co-invest alongside the fund. Since 2012 the EIS Fund has invested £33.4 million into 53 investee companies and has generated exit proceeds of £6.1 million, with a remaining portfolio balance of £33.4 million (September 2023). Note, past performance is not a guide to the future.

- Tax certificate expected 12-24 months after closing date

- Target pre-tax return of 15% IRR over an expected holding period of 6-8 years – not guaranteed

- Targets a portfolio of 8-12 companies to deploy within 12 months of the subscription date – not guaranteed

- Minimum investment of £25,000

Important: The information on this website is for experienced investors. It is not a personal recommendation to invest. If you’re unsure, please seek advice. Investments are for the long term. They are high risk and illiquid and can fall as well as rise in value: you could lose all the money you invest.

The manager

Based in Edinburgh, Par Equity LLP (“Par” or “Par Equity”) is an early-stage venture capital firm seeking to back innovative, high-growth technology companies. It made its first investment in March 2009 and launched the EIS fund in 2012, originally formed to invest alongside the Par Investor Network. Its first knowledge-intensive fund followed in 2022/23.

To date, Par Equity, including the Par Investor Network and institutional money managed by Par, has invested £170.3 million into EIS-qualifying companies, and generated exit proceeds of £137.3 million, with a remaining portfolio balance of £132.2 million. Past performance is no guide to the future.

Par Equity’s investment team consists of 10 investment professionals Chairman Leith Robertson, five partners, two investment directors and two investment managers. The team includes professionals with backgrounds across consulting, corporate finance, and the technology industry. The members of the Par team have personally invested £6.9 million in the portfolio (March 2023), and all the Partners invest into the EIS Fund every year on identical terms to investors. This aligns their interests with those of investors.

The investment team is also supported by the Par Investor Network, a group of over 200 experienced business angels. The Par Investor Network can provide Par with additional deal flow and support with due diligence as well as funding.

Before your subscription is invested into shares, the cash will be held by the custodian, Kin Capital Partners LLP. Shares will be held by the nominee, KCP Nominees Limited.

Investment strategy

Par seeks to invest in companies with collaborative management teams that are developing innovative, hard to replicate solutions across sectors such as: enterprise software, health care and medical devices, industrials and space, energy and resources, food security, and digital media and entertainment. Par’s KI EIS Fund is managed by the same team as its standard EIS fund and will follow a similar strategy, however, it is expected to invest in 8-12 companies (compared to 7-8).

Par looks for large addressable markets with limited barriers to international scale and strong commercial demand and market pull, targeting monthly revenues of at least £20,000. Historically, 60% of the investments made by the EIS fund were generating monthly revenues of more than £20,000 at the time of investing. Par Equity tends to participate in investment rounds of between £0.5 million and £10 million.

Par invests in companies across the UK, but with a bias towards opportunities in Scotland, Northern Ireland, and the north of England. Par believes that, together with its Par Investor Network (detailed below), its regional focus means that it may see opportunities at what it considers more realistic valuations and which may be missed by a London-centric manager with a similar investment outlook. Scottish-based portfolio companies also benefit from the support of the Scottish Investment Bank and Scottish Enterprise.

The manager also feels that the involvement of the Par Investor Network gives it an edge. The Network’s 200+ members are experienced business angels and have deep expertise in their respective fields, so are often approached by entrepreneurs operating in their sector, which may give Par access to pre-screened businesses that competitors might not see. Par believes that the Network also brings valuable expertise and skills in specific sectors and technology that can complement Par’s own capabilities, with members often attending investee company pitches. After investment, Network members often serve as Par’s representatives and observers on investee company boards as well as providing ongoing mentoring through to exit.

Knowledge-intensive approved EIS funds: how do they work?

Knowledge-intensive (or KI) approved EIS funds were introduced in March 2020.

A KI fund must invest 80% of its portfolio in “knowledge-intensive” companies. These are businesses that are carrying out research, development, or innovation at the time of investment.

Provided certain conditions are met, a KI approved EIS fund allows investors to set their income tax relief against liabilities in the same tax year the fund closes or to carry back to the previous year, whereas a conventional EIS fund will allow investors to claim tax relief based on the tax year in which each individual investment is made or carry back to the previous tax year.

To claim EIS tax relief, investors will have to receive their EIS certificate first. Investors in KI funds can expect to receive a single EIS5 certificate, issued by the fund once it has invested 90% of its capital, which it is required to do within 24 months of the close. In contrast, investors in non-approved funds will receive individual EIS3 certificates for each investee company as and when the fund deploys capital.

Please note: tax rules can change and benefits depend on circumstances. To maintain KI approved status, the fund needs to comply with requirements set out by HMRC. Should the fund fail to do so, it will impact investor tax relief.

Portfolio

To date, the Par EIS Fund has invested £33.4 million into 53 companies.

Investors in the Par KI EIS Fund can expect exposure to a target portfolio of eight to 12 underlying companies. The first iteration, launched in 2022/23, has so far invested £4.8 million into 11 companies.

Source: Par Equity, sector breakdown by cost for Par EIS Fund (September 2023).

The companies outlined below are historic investments made by the Par KI EIS Fund in its previous iteration and give a flavour of the types of companies a new investor might expect.

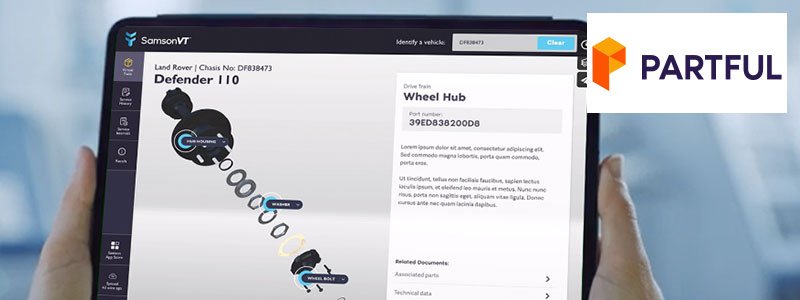

Partful

Partful

During his time in the army, Sam Burgess (founder of Partful) became more than familiar with equipment breaking down. However, his team’s repair efforts were often hampered by complicated or outdated technical manuals.

Partful was launched in 2017 to address this. Its immersive 3D technology creates “explosion views”, a process which separates a product into its individual components. These models turn even the most complicated machines into simple step-by-step guides and help customers easily locate and replace broken parts. The result is a decrease in product downtime, faster fulfilment and repairs, and reduced order errors.

Par initially backed Partful in January 2022, since then, the business has grown revenues over 100% year-on-year and secured contracts with a string of new clients, including global manufacturers such as Lotus Cars, Norton Motorcycles, and BAE Systems.

The Par KI EIS Fund invested £589,000 in June 2023 as part of a £2.4 million round alongside Blumberg Capital. The funding will be used to expand Partful’s engineering team and accelerate growth in the UK and the US.

Neuranics

Neuranics

Founded in 2021, Neuranics is a joint spinout from Edinburgh and Glasgow Universities.

The company has developed a new way to capture signals between the brain and muscles. Muscular activity is commonly recorded using electromyography (EMG) which takes readings from electrodes placed under the skin. However, this method has limited sensitivity and in extreme cases can lead to muscle damage. In comparison, Neuranics’ sensor is non-invasive, using a small magnetic sensor to accurately detect muscle activity.

Neuranics believes the sensor will enable new forms of human-machine interaction, including interacting with virtual objects in the metaverse. The company is currently targeting health and fitness monitoring devices (such as activity watches) as well as next-generation bionics which can be controlled by neural signals, just like real limbs.

The Par KI EIS Fund invested £372,000 in September 2023 as part of a £1.9 million round alongside Creator Fund, University of Edinburgh, and University of Glasgow.

Current Health – example of previous exit

Current Health – example of previous exit

Founded in 2015, Current Health brings together remote patient monitoring, telehealth, and patient engagement into a single platform for healthcare organisations.

Patients wear a wireless device (armband) that continuously gathers data. The platform uses that data to provide real-time insights into a patient’s condition – optimising patient outcomes and cost of care and helping health organisations deliver safe and effective care at home.

Today, 13 of the largest healthcare systems in the US and UK – including Mount Sinai and Dartford & Gravesham NHS Trust – use Current Health to manage patient care.

Par EIS invested in Current Health’s seed round in April 2017, selling its stake for 8.3x cost in November 2021 when the company was acquired by US retail giant Best Buy for $400 million. Past performance is not a guide to the future.

Swipii – example of previous failure

As with any early-stage investment, not all will work out as planned. Local cashback platform Swipii is an example. Swipii allowed local restaurants, cafes and bars to offer users cash back through the app, acting as a marketing tool for small businesses.

Par initially invested in the business in January 2019 alongside Scottish Enterprise, providing further funding in 2020 and 2021 with the final round valuing the business at £6.9 million. However, the challenges of the pandemic, a protracted recovery and poor jobs market means the company fell into liquidation in late 2021.

While the company may be resurrected under new owners, Par has subsequently written off its entire investment.

Performance

Since inception in 2011 the Par EIS Fund has invested £33.4 million into 53 investee companies and has generated exit proceeds of £6.1 million, with a remaining portfolio balance of £33.4 million (September 2023).

The chart below shows the average performance of the total subscribed into the Par EIS Fund in each full tax year from 2012/13 (or from when the current strategy was adopted if later) to 2022/23. The first Par KI EIS Fund started making its first investments in May 2023, so it does not yet have a performance track record spanning 12 months.

The chart is based on the latest valuations provided by the manager, expressed on a £100 invested basis. Please note, individual investor portfolios’ performance will deviate from the average.

Performance per £100 invested per tax year (Par EIS Fund)

Risks – important

This, like all investments available through Wealth Club, is only for experienced investors happy to make their own investment decisions without advice.

EIS investments are high-risk and should only form part of a balanced portfolio. As must be expected with early-stage investments, some or even all of the companies in the portfolio could fail: the fewer the companies included in the portfolio, the higher the risk of loss if things don’t go to plan. You should not invest money you cannot afford to lose.

There is no ready market for unlisted EIS shares: they are illiquid and hard to sell and value. There will need to be an “exit” for you to receive a realised return on your investment. Exits are likely to take considerably longer than the three-year minimum EIS holding period; equally, an exit within three years could impact tax relief.

To claim tax relief for a knowledge intensive EIS fund you will need an EIS5 certificate. Certificates can be used once the fund has invested 90% of its capital, which it is required to do within 24 months of the close. Tax reliefs depend on the portfolio companies maintaining their EIS-qualifying status. Remember, tax rules can change and benefits depend on circumstances.

Before you invest, please carefully read the Risks and Commitments and the offer documents to ensure you fully understand the risks.

Charges

A summary of the main charges is shown below. Some of these will be payable by the investor, whilst others by the investee companies. The investment may have additional charges and expenses: please see the provider documents, including the Key Information Document, for more details.

| Investor charges | |

|---|---|

| Full initial charge | 3% |

| Wealth Club initial saving | — |

| Net initial charge through Wealth Club | 3% | Annual management charge | 1% |

| Administration charge | — |

| Dealing charge | — |

| Performance fee | 20% | Investee company charges |

| Initial charge | up to 5% | Annual charge | See below |

More detail on the charges

Our view

The fund has a small and close-knit investment team yet, through the Investor Network, it can access a pool of c.200 experienced investors. They can provide deal flow, help with due diligence, take board seats, and actively engage with and add value to investee companies.

The fund’s focus on regions of the UK underserved by the wider venture capital community has the potential to create what Par sees as attractive entry valuations and a destination for entrepreneurs seeking funding, particularly within Scotland, Northern Ireland, and the north of England.

Par’s investment approach has led to total exit proceeds topping £137.3 million on an investment cost of £170.3 million, and a portfolio balance of £132.2 million. However, investors should note the total Par Equity track record, which includes the Par Investor Network and institutional funds managed by Par, has historically generated superior returns to the EIS fund. Past performance is not a guide to the future.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.

The details

- Type

- Fund

- Sector

- Technology

- Target return

- -

- Funds raised / sought

- -

- Minimum investment

- -

- Deadline

- CLOSED