Praetura Growth VCT

Share offer coming soon – Register your interest

In July 2024, the directors of Praetura Growth VCT announced their intention to launch a new offer for subscription. Details of the offer are intended to be published in the coming months.

You will be able to download documents and apply online here.

Please register your interest below and we will alert you when the VCT re-opens for subscription.

Register your interest – Praetura VCT

This is a new VCT managed by Praetura Ventures (“Praetura”), a venture capital firm focused primarily on the North of England.

Praetura Ventures is a division of Praetura Group, which was founded in 2011 to provide funding to small and medium-sized enterprises. The group has £544 million assets under management, of which £213 million within Praetura Ventures.

In 2019, Praetura Ventures launched its EIS fund, which has to date raised £56 million and backed 36 EIS-qualifying companies. Praetura Ventures also manages £20 million on behalf of British Business Investments Regional Angel Programme, and a £20 million Life Sciences fund for Greater Manchester Combined Authority.

The VCT will follow the same investment strategy as – and co-invest with – the EIS funds, targeting regional businesses with a focus on the technology and healthcare sectors. Initially, it is expected to make follow-on investments in Praetura’s existing portfolio companies.

The VCT aims to start paying an annual dividend of between 4-6p per share from 2027. Dividends are variable and not guaranteed.

- Seeking to raise up to £10 million, with a £10 million overallotment facility

- Targets annual dividends of between 4-6% of NAV from 2027 – not guaranteed

Important: The information on this website is for experienced investors. It is not a personal recommendation to invest. If you’re unsure, please seek advice. Investments are for the long term. They are high risk and illiquid and can fall as well as rise in value: you could lose all the money you invest.

The manager

Praetura Group was founded in 2011 to capitalise on what the founding partners believe is a sizeable opportunity to invest in early-stage businesses in the North of England. Today it consists of six subsidiary businesses, including Praetura Ventures, which provide a range of operational and financial services. The Group currently has assets under management of £544 million.

Praetura Ventures was established in 2018. A year later, Praetura's first EIS fund was launched, and has since raised £56 million.

Praetura has an investment team of 17, split between three divisions: technology, healthcare, and portfolio. The technology and healthcare teams are responsible for due diligence and deal selection while the portfolio team provides post-investment strategic support. Praetura’s network of eight Operational Partners – who previously had senior roles at companies such as Apple, AO.com, and Dr Martens – serve as mentors to the portfolio.

Praetura has developed its own reporting software, which helps the team understand its portfolio companies. As well as supporting investment and portfolio management decisions, this enables the manager to produce, in our view, high-calibre investor communications.

Praetura staff, Operational Partners and people associated with the manager have committed to personally invest £1 million into the VCT.

Meet the manager – Praetura cofounder David Foreman:

Investment strategy

The North of England accounts for around 20% of the UK’s population, economic output, and active companies but just 7% of the UK’s venture capital investment. Praetura believes there is a funding gap of almost £10 billion for early-stage businesses in the region. The Praetura Growth VCT aims to capitalise on this opportunity.

The manager favours B2B business models, as they typically provide access to larger clients and stickier revenue streams. Companies must be scalable and be able to demonstrate momentum at the point of investment. Ideally, businesses should be considered capable of doubling revenues each year post investment.

The fund aims to invest up to two-thirds of funds raised in companies based outside London and the South East. The portfolio is likely to be weighted towards technology and healthcare although the team will consider any sector.

Due to its strong regional network, Praetura does not do any outbound deal sourcing. Instead, it relies on its partnerships with accountancy firms and accelerator programmes to provide opportunities as this also provides external validation. The investment team reviews over 200 opportunities each month. In each deal, Praetura aims to be one of the first institutional investors, looking to lead rounds with an investment of £1 million to £3 million and to take an initial equity stake of 5-30%.

Once a company receives investment, Praetura will offer strategic support through a range of services. Investee companies will have access to its Operational Partners programme, corporate partnerships, and Praetura’s in-house financial reporting platform which is integrated into each business.

Current portfolio overview

As this is a new VCT, it has yet to make any investments.

Praetura expects to make six to eight follow-on investments into companies it has previously backed through its EIS fund. The trust will then seek to deploy capital of between £1-£5 million into qualifying investments, depending on funds raised. Please note, it may take several years to establish a well diversified portfolio.

Below are details of previous investments made by the Praetura team through the EIS fund. Please note, there is no guarantee these companies will be included in the initial portfolio.

Example portfolio companies

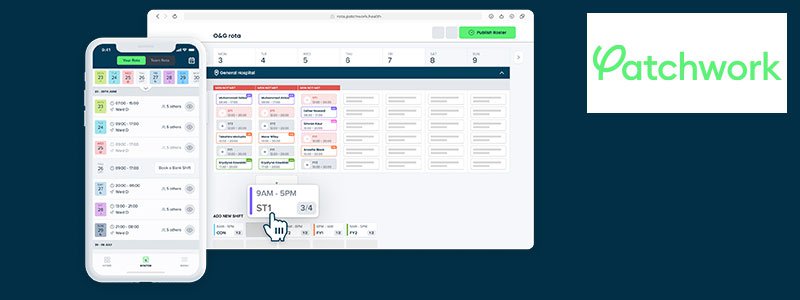

Locumtap (trading as Patchwork)

Locumtap (trading as Patchwork)

Founded by two doctors, Anas Nader and Jing Ouyang, Patchwork aims to help address the NHS staffing crisis.

In 2021/22, empty shifts cost the NHS £3 billion in agency fees, with some trusts paying up to £2,500 for a single shift. Patchwork’s platform does away with expensive agencies, connecting healthcare providers directly with clinicians. Its platform acts as a hub, allowing managers to broadcast shifts in real-time to a staff bank of thousands. In return, workers can book shifts instantly, at times and locations suited to them.

To date, Patchwork believes it has saved the NHS more than £40 million in agency costs. It now serves more than 100 healthcare sites across the UK and has over 40,000 staff on its books.

Praetura initially led a £3 million investment round in 2020, committing £1.9 million alongside other investors. It has since provided £3.6 million in follow-on funding and the total holding is currently valued at £7.5 million. Past performance is not a guide to the future.

BankiFi

BankiFi

BankiFi has created technology specifically designed to help banks serve their business customers – particularly small businesses – better.

Historically, banks haven’t had a dedicated offering for small businesses. As a result, small businesses are turning away from banks and moving to alternative payment processors and finance providers.

BankiFi helps banks stay relevant by enabling them to provide a set of integrated services - accounting, invoicing and payments - designed around the processes their customers use to run their business. This means customers can consolidate their payments, invoicing, and accounting needs into one package and banks gain access to new revenue streams and improve retention.

BankiFi’s founder, Mark Hartley, has over three decades experience in the sector. Most notably, helping to scale Clear2Pay, a global payments provider, to a €375 million exit. Since launching in 2017 the business has secured multiple contracts with international banking clients, processed over £1 billion in payments, and expanded into the US, achieving a 9x growth in annualised recurring revenue.

In total, Praetura has invested £4 million into the business and the holding is currently valued at £5.39 million. Past performance is not a guide to the future.

Exit track record

As this is a new VCT there is no track record. However, the team has previously achieved five successful exits from its EIS investments, including EC3 Brokers (19.2x realised return) and Pib (3x realised return). Praetura believes each would have been VCT qualifying under current rules. Past performance is not a guide to the future.

An example of failure is Ostara Biomedical. The company created technology designed to improve fertility through a cheaper and less invasive alternative to IVF. However, technical development was significantly disrupted by the pandemic and the business operated at a reduced capacity. The management team was not able to raise funds in 2021 and Praetura was not comfortable leading a funding round without external validation. The business filed for administration in June 2022.

Performance and dividends

The VCT is targeting an annual dividend of 4-6% of NAV from 2027, not guaranteed.

As this is a new VCT, there is no performance track record. However, it will be managed by Praetura Ventures, the same team responsible for the EIS fund as well as Praetura’s previous EIS investments.

Since 2011, Praetura has invested a total of £108.7 million in 44 EIS-qualifying companies (36 through the EIS fund), achieving 10 exits, five of which were profitable.

In aggregate, Praetura has returned £47.7 million to investors and has a remaining portfolio balance of £164.0 million before tax relief. See the track record for Praetura’s EIS-qualifying investments below. Past performance is not a guide to the future.

Performance of EIS-qualifying investments per £100

Performance of Praetura EIS Growth Fund after launch per £100 invested

Dividend payments in the calendar year

The VCT does not expect to pay a dividend until at least 2027 – not guaranteed.

Share buybacks

The VCT plans to operate a policy of purchasing their own shares as they become available in the market at a discount of up to 5% to the latest published NAV. This is not guaranteed – please see the offer documents for details. The discount to NAV could also be greater or less than 5%.

Risks – important

This, like all investments available through Wealth Club, is only for experienced investors happy to make their own investment decisions without advice.

VCTs are high-risk so should only form part of a balanced portfolio and you should not invest money you cannot afford to lose. They also tend to be illiquid and hard to sell and value. Before you invest, please carefully read the Risks and Commitments and the offer documents to ensure you fully understand the risks.

To retain the tax benefits, VCTs should be held for at least five years. If you sell VCT shares and reinvest in new shares of the same VCT (including any mergers) within six months, tax relief can be restricted. Tax rules can change and benefits depend on circumstances.

As this is a new VCT it will take time to build a portfolio of investments, during this time the trust is likely to be more concentrated and no dividend payments are expected until at least 2027. If the raise is smaller than expected, costs may have a larger impact than intended.

The offer is conditional upon the minimum subscription (£3 million) being reached. If fundraising is slow, or does not materialise, shares will not be allotted.

Charges and savings

A summary of the main charges and savings is shown below. The net initial charge shown includes the Wealth Club saving and any early bird discount. The investment may have additional charges and expenses: please see the provider documents including the Key Information Document for more details, offer price and share allotment calculation methodology.

Please note, capacity – for the offer or any early bird savings – can be reached early, and we may not be notified of this by the VCT in real time.

| Full initial charge | 3% |

| Early bird discount | — |

| Wealth Club initial saving | 1% |

| Existing investor discount | — |

| Net initial charge through Wealth Club (new investors) | 2% |

| Net initial charge through Wealth Club (existing investors) | 2% |

| Annual management charge | 2% |

| Annual administration charge | 0.35% |

| Performance fee | 20% |

| Annual rebate from Wealth Club | 0.15% |

More detail on the charges

Annual rebate when you invest through Wealth Club

The Praetura Growth VCT includes an annual rebate for Wealth Club investors, payable for the first three years.

This should be equivalent to a percentage (shown in the table above) of the Net Asset Value of your shares and will be paid out of our standard ongoing renewal commission. Terms and conditions apply.

Our view

Praetura Ventures has ambitions to become one of the UK’s leading venture capital businesses. It has built a well resourced, professional venture capital team and has developed a reputation as a committed regional investor, with the majority of its portfolio based outside of London and the South East. This focus, combined with the team’s post-investment support, helps Praetura attract deal flow from across the UK, providing the VCT with a large pipeline of opportunities.

While this is a new VCT, Praetura is an experienced manager and has been investing in early-stage companies for over a decade. It has seen some success in that time, with five profitable exits and several other portfolio companies showing encouraging progress, as reflected in the unrealised returns. Past performance is not a guide to the future.

Investors should note that, as a new VCT, it will not be paying dividends for some years. The portfolio is also likely to be concentrated in the early years, potentially making it a riskier investment. In addition, the offer is conditional on the minimum of £3 million being raised (Praetura staff, Operational Partners and people associated with the manager have committed to personally invest £1 million). Nonetheless, this may be worthy of consideration to complement an existing VCT portfolio.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.

The details

- Type

- Generalist

- Target dividend

- -

- Initial charge

- -

- Initial saving via Wealth Club

- -

- Net initial charge

- -

- Annual rebate

- -

- Funds raised / sought

- -

- Deadline

- Coming soon