EIS and SEIS capital gains tax relief: more valuable now than ever?

Archived article

Archived article: please remember tax and investment rules and circumstances can change over time. This article reflects our views at the time of publication.

From 6 April, the annual tax-free allowance for capital gains will be cut by half, from £12,300 to £6,000, then cut again to £3,000 from April 2024, reaching the lowest level since 1981.

As many as half a million people are expected to be affected and the measure is estimated to bring in an additional £440 million for the taxman by 2027/28.

Tax planning can go a long way to minimise Capital Gains Tax (CGT) liabilities. However, what if you have already realised a taxable gain and face a CGT bill? What reliefs are available?

Experienced investors could receive CGT relief by investing through EIS and SEIS:

- EIS offers Deferral Relief, so you could defer taxable gains, potentially indefinitely;

- SEIS offers Reinvestment Relief, so you could save up to 50% on a CGT bill.

Important: tax rules can change and benefits depend on circumstances. EIS and SEIS invest in small, young companies, so are high risk. You should not invest money you cannot afford to lose. The minimum holding period to retain the tax reliefs is three years and the investment must remain qualifying. This is a simplified explanation of complex rules: if in doubt, please seek specialist advice.

Defer taxable gains when you invest in EIS

Deferral Relief is one of the lesser-known tax perks of the EIS.

You could defer a taxable gain – and the resulting CGT – if you invest that gain into EIS. The CGT bill would only normally become due – at the prevailing rate – when the EIS investment is realised. Alternatively, you could re-invest in another EIS and continue to defer the gain potentially indefinitely.

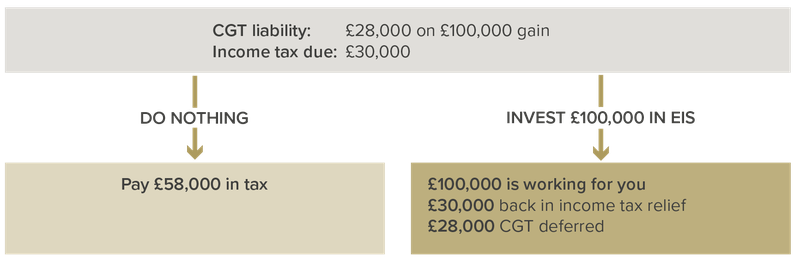

How could EIS Deferral Relief work in practice?

Imagine you have realised a taxable gain of £100,000 from selling a buy-to-let property (in reality, the gain could be from selling any asset: shares, a business, a holiday home, etc.) and have a £28,000 CGT liability alongside a £30,000 income tax liability.

You could invest £100,000 into an EIS, save up to £30,000 income tax (through EIS income tax relief) and defer £28,000 of CGT. As a result, you would have £100,000 working for you, instead of having to pay a £58,000 tax bill. Remember, though: these generous tax reliefs are offered by the government in recognition of the high risks of investing in small UK businesses: you could lose all the money you invest.

EIS Deferral Relief at a glance – an example

For illustrative purposes only. Assumes you are a higher or additional-rate taxpayer and have already used your CGT-free allowance. The 28% rate of CGT applies to residential property: other chargeable gains might incur a rate of 20%. Tax rules can change and benefits depend on circumstances.

There’s no upper limit on the value of gains that can be deferred.

To qualify for deferral relief, the reinvestment into EIS must be made at least 12 months prior to, or three years after, the original gain was made.

A deferred gain dies with you

If you die whilst you own the EIS shares, the gain dies with you and no CGT is payable.

This could be attractive to older investors who are comfortable with the much greater risk and might want to sell down assets such as second homes: it provides a way of passing down money to the next generation without having to pay CGT or IHT (EIS investments should also qualify for IHT relief after two years, if you still hold them on death).

What should you bear in mind?

In addition to the considerable risks of investing in small, young companies, there are two things you should bear in mind when deferring a gain.

Firstly, you are deferring the gain, not eliminating it. When the investment is realised, the CGT bill would become payable. That applies even if the investment is realised at a loss or at no value at all. One mitigating factor is that you should be able to write off losses either against your capital gains tax liability or income tax liability through EIS loss relief.

Secondly, when the CGT becomes payable, the prevailing rate at that time will apply. This could be higher or lower than the rate at the point of the EIS investment. Remember, tax rules can and do change and the value of benefits will depend on individual circumstances.

Save up to 50% on a CGT bill when you invest in SEIS

When you invest in SEIS, you may be able to cut your CGT liability in half (this is called Reinvestment Relief).

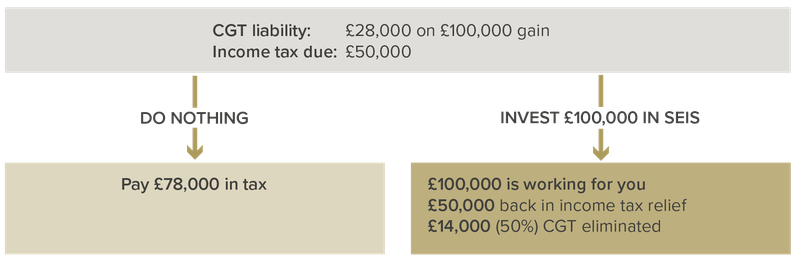

How could SEIS Reinvestment Relief work in practice?

Imagine you have a £100,000 taxable gain (£28,000 CGT liability) and a £50,000 income tax bill.

If you invest £100,000 in SEIS, you could claim up to £50,000 back in income tax and £14,000 (half of £28,000) in CGT.

This means instead of paying a total tax bill of £78,000, you have £100,000 working for you. Moreover, that £100,000 SEIS investment could effectively cost you as little as £36,000, once you take the tax reliefs into account.

SEIS Reinvestment Relief at a glance – an example

For illustrative purposes only. Assumes you are a higher or additional-rate taxpayer and have already used your CGT-free allowance. The 28% rate of CGT applies to residential property: other chargeable gains might incur a rate of 20%. Tax rules can change and benefits depend on circumstances.

Unlike EIS, SEIS Reinvestment Relief is capped. To claim Reinvestment Relief you must have claimed the income tax relief in the same tax year. So, in the above example, to claim full relief on the £28,000 CGT bill, you would first have to claim the £50,000 income tax relief in the same tax year. The maximum you can invest in SEIS with tax relief is currently £200,000.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.