Record £1.13 billion VCT fundraising in 2021/22: the numbers…

Archived article

Archived article: please remember tax and investment rules and circumstances can change over time. This article reflects our views at the time of publication.

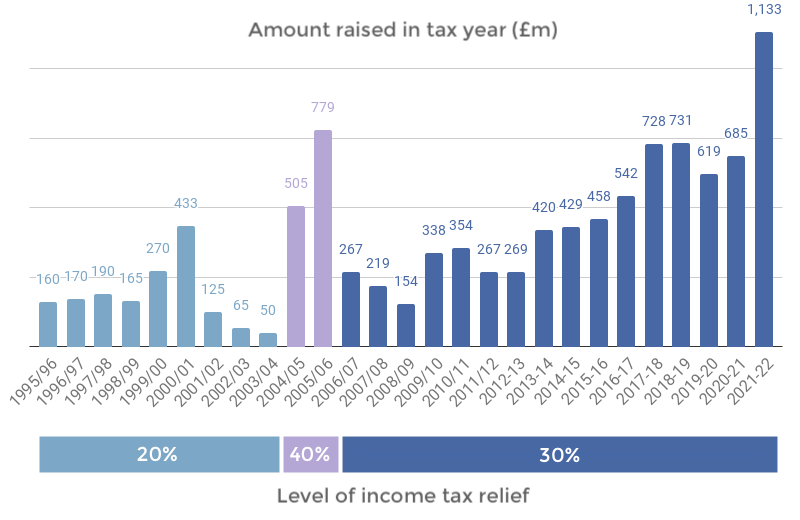

Venture Capital Trusts raised £1.13 billion in the 2021/22 tax year – 65% more than in the previous year.

This is the highest amount raised by VCTs in a tax year, exceeding the previous record of 2005/06 when income tax relief on VCT investments was at the higher level of 40%. Remember, tax rules can change and benefits depend on circumstances.

The most popular offers filled well in advance of tax year end. Overall, 13 of the year’s 27 offers were fully subscribed by the end of March 2022.

The most popular offers filled well in advance of tax year end. Overall, 13 of the year’s 27 offers were fully subscribed by the end of March 2022.

Richard Stone, Chief Executive of the Association of Investment Companies (AIC), commented: “This record level of VCT fundraising is excellent news for the UK’s small and fast-growing businesses. Last year VCTs invested just under £670 million in small private companies and AIM companies. These companies deliver important economic and social benefits to the UK, which range from exports and increased tax take to cutting edge technology and job creation in sectors as diverse as healthcare, online retailing and green technology.”

A fast start

Amati AIM VCT got the year off to a fast start – all the more surprising since it opened in what is usually a quiet time of year. The offer raised £40 million within 5 days of opening on 30 July 2021. Wealth Club clients submitted £6.9m of applications on the first day. The offer later reopened, using its overallotment facility, raising a further £25 million in 5 days in February 2022.

The autumn – traditionally the start of ‘VCT season’, when many of the year’s offers open – demonstrated strong demand. 22 VCT offers had raised £514 million by the end of November, which was 2.2x the amount at the same stage of the previous year.

In particular, Octopus Titan VCT filled faster than in any previous tax year. The UK’s largest VCT, it regularly raises the highest overall amount, but its offer is usually open into March or April. This year it raised £200 million in 28 days, closing in mid-November – hence the ‘bump’ in the cumulative chart below.

Play the animated chart to show the overall amount raised by VCT offers that opened in 2021/22, compared to previous tax years:

After the last two tough years, investors are particularly interested in VCTs, which support entrepreneurs and help build back the economy.

Richard Stone, Chief Executive, AIC

How much did each VCT offer raise?

This year was notable for the number of VCTs raising funds – nearly every currently active VCT had a share offer. The Albion VCTs raised their most ambitious target to date, and all of Baronsmead VCTs, British Smaller Companies VCTs, Northern VCTs and Mobeus VCTs had offers in the same tax year for the first time since 2017/18.

All in all, 27 share offers (compared to 22 last year) raised money for a total of 42 Venture Capital Trusts (30 last year).

Here is an animated chart of the VCT offers that opened during the tax year. See how the different offers progressed and where they ended up:

Facts and figures on 2021-22 VCT fundraising

Largest amounts raised

The year’s biggest fundraise was Octopus Titan VCT (£200m) – up from £120m last year.

Octopus also raised £40m for its AIM VCTs, £41.6m for Apollo VCT (which still plans to use its overallotment facility in 2022/23), and also launched a new VCT, Octopus Future Generations, that raised £32.3 million.

The second largest fundraise came from Albion Capital – the six Albion VCTs raised £96.5m (last year: £58.5 million).

Baronsmead VCTs raised £75 million, and Amati AIM VCT (£65m) and British Smaller Companies VCTs (£60m) complete the top five.

Fastest sellers

The year set two records for fastest-selling fundraises.

First, Amati AIM VCT raised £8m per day in summer 2021, opening its offer on Friday 30 July and closing on Wednesday 4 August having raised £40m. Then in January 2022, Mobeus VCTs filled their £35m raise within 24 hours – the fastest fundraise by a wide margin.

AIM VCTs

AIM VCTs focus on VCT-qualifying companies listing new shares on AIM.

These offers were in high demand during the year, with £170m raised across four offers – 68% more than the previous year. As well as the Amati AIM VCT offer mentioned above, the two Octopus AIM VCTs raised £40m and closed in September 2021; Hargreave Hale AIM VCT raised £40m by mid October; and Unicorn AIM VCT raised £25m in February 2022.

New VCTs

One new VCT launched in 2021/22: Octopus Future Generations, which raised £32.3m by the end of the tax year.

Other young VCTs – Puma Alpha VCT and Blackfinch Spring VCT, which launched in 2019-20, as did new share classes of Triple Point VCT 2011 and Foresight Solar & Technology VCT – all raised funds again, raising more on aggregate (£30.3m) than in previous tax years (£25.8m in 2020/21, £21.1m in 2019/20).

Ian McLennan, lead fund manager on the Triple Point Venture Fund, which raised £15.8 million in the tax year, commented: “We’re delighted with the strong fundraise – a huge thank you to our investors for their support. It is reflective of continued interest from investors to diversify their VCT holdings. We will continue to fund earlier stage British innovation, focusing our expanded resources on innovative UK technology companies at seed stage, giving them the capital to demonstrate that their products can scale to serve a wider customer audience.”

Current VCT investment opportunities

Many offers have closed, but several VCTs remain open into 2022/23.

If you are an experienced investor comfortable with the risks and believe VCTs may be for you, there may be good reasons to consider investing at the start of the tax year. For example, you could potentially receive an extra year’s worth of dividends, which are variable and not guaranteed. The income tax relief could be paid to you during the year, rather than reclaimed afterwards via your tax return. Tax rules can change and tax benefits depend on circumstances.

Remember, the speed, size and success of a VCT’s fundraise does not necessarily indicate how well the investment will perform in the future. You should form your own considered view and read the offer documents carefully before investing. If unsure, seek advice.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.