Puma VCT 13

Offer now closed – Register your interest for the next

Puma VCT 13 is now closed (5 July 2024). Please register your interest below and we will alert you when it reopens for subscription. Alternatively, please have a look at current VCT offers.

Register your interest – Puma VCT 13

Puma VCT 13 is a generalist trust, seeking scale-up opportunities and co-investing alongside other Puma funds. It first issued shares under the current structure in July 2018.

The VCT has net assets of £118.6 million, and a portfolio of 20 companies (February 2024). While the portfolio is concentrated, with three companies accounting for around a quarter of net assets, the companies are spread across multiple sectors, ranging from a global influencer marketing agency to a travel accessibility platform.

Over the five years to 31 March 2024, the VCT has generated a NAV total return (including dividends) of 56.7%. This includes dividend payments of 16.5p per share, following two exits from previous investments. Past performance is not a guide to the future and dividends are variable and not guaranteed.

- Seeking to raise up to £50 million with a £20 million overallotment facility

- Targeting an average annual dividend of 5p per share – variable and not guaranteed

- Invest in the 2024/25 tax year

- Minimum investment £3,000 – you can apply online

- Offer closes 5 July 2024 (5pm)

Important: The information on this website is for experienced investors. It is not a personal recommendation to invest. If you’re unsure, please seek advice. Investments are for the long term. They are high risk and illiquid and can fall as well as rise in value: you could lose all the money you invest.

The manager

Puma VCT 13 is managed by Puma Investments and advised by its Private Equity arm, Puma Private Equity Limited.

Puma has a 27-year track record of investing in small and medium-sized enterprises. In total, it has launched 14 VCTs, investing more than £340 million into 58 qualifying companies, and achieving 36 full exits – please note, past performance is not a guide to the future (February 2024).

The Puma Private Equity team is headed up by Rupert West, who has 16 years’ investment experience and is responsible for sourcing and leading VCT and EIS investments. He is supported by eight investment professionals (four investment directors, one investment manager, two investment executives, and one portfolio value creation lead). They have access to Puma Investments’ support services, including in-house legal counsel and its senior management team.

Meet the manager – watch our interview with Rupert West:

Investment strategy

Puma is sector agnostic, preferring to focus on the stage of a business instead.

The VCT favours scale-up opportunities, rather than startups: well managed, established, unquoted companies with a clear market fit, typically generating revenues of £2 million or more.

The investment team believes that companies at a similar stage of growth tend to face similar problems. Therefore, by focusing solely on scale-ups, the VCT can share its experience and help companies navigate common pitfalls while creating sector diversity within the portfolio.

Puma looks to add value by establishing best practices, supporting strategy refinement and networking opportunities through Puma’s Senior Management and CFO Clubs.

Puma sources the majority of its deals through its established network of corporate advisers and entrepreneurs. However, it also conducts outbound enquiries to identify its own deal flow and help the team maintain a wider perspective.

Given the similarity in investment strategy, it is expected that Puma VCT 13 will co-invest with Puma Alpha VCT and Puma Alpha EIS on the majority of its investments.

Current portfolio overview

Puma VCT 13 has net assets of £118.6 million: a portfolio of 20 unquoted companies valued at £78.5 million, or 66.2% of net assets, with the remainder held in cash and short term bonds to help manage liquidity (February 2024). In the year to February it invested a total of £27.6 million across seven new and five follow-on investments.

The VCT is still quite concentrated with nearly a quarter of its net assets within its three largest holdings: Influencer (9.5%), Le Col (9.1%) and CameraMatics (5.2%) (February 2024).

The investments are split across different sectors including business services, consumer, and software. Please note: in the chart below some of the sectors may only include one company.

Source: Puma Investments, sector allocation by value, February 2024.

Example of portfolio companies

Influencer – largest holding

Influencer – largest holding

Influencer is one of the UK’s first influencer marketing platforms. It connects brands – its clients span from Barclays and the UK Army to Amazon, Xbox, and the FIFA World Cup – with content creators, or influencers to create marketing campaigns that turn creators’ followers into a brands’ consumers.

The company’s technology simplifies the process of collaboration and cleverly uses data to optimise campaign effectiveness. It is also an official partner of several leading social media platforms, including YouTube, Meta, and TikTok.

Influencer has been instrumental in producing award-winning campaigns for Google, Vodafone, SharkNinja, Pernod Ricard and Levi’s – to name a few. In 2022, it secured 42nd place in Deloitte’s Fast 50, with 965% growth over its past four full financial years.

In September 2023, the company launched Amplify, a campaign service for brands. With Amplify, brands only need to submit a basic brief and Influencer will take care of the rest, leveraging its creator and content network to produce trending campaigns in as little as two weeks.

To date, the VCT has invested £1.8 million. The holding is currently valued at £11.2 million – a 6.25x uplift – and accounts for 9.5% of net assets; past performance is not a guide to the future.

Transreport – recent investment

Transreport – recent investment

Transreport is a technology platform which aims to improve accessibility across the travel industry.

The business initially targeted the rail industry where passengers with accessibility needs were required to book travel assistance over the phone, a process that could take up to 40 minutes. These requests would then be communicated to transport staff though daily printouts, making it difficult to coordinate support in the case of cancellations, delays, or platform changes.

In contrast, Transreport’s service (Passenger Assist) allows users to book, change, and cancel assistance quickly, create profiles to specify the type of assistance required, and provides staff with live information to accommodate changes at short notice. The service has already been adopted by rail companies across the UK.

By December 2023, it had been used by over 200,000 passengers and recently partnered with Hankyu Corporation, one of Japan’s leading railway companies. Transreport has since expanded into the aviation industry, announcing a partnership with East Midlands Airport in May 2024 and reporting interest from air transport hubs in the Middle East.

Puma VCT 13 invested £5.4 million in the business in January 2024, with Puma Alpha VCT also investing £1 million.

Exit track record

The VCT’s portfolio is still relatively young. It has suffered no failures to date, although these are to be expected. To date, the VCT has achieved two full exits, Pure Cremation and Tictrac (see below), generating an average return of 3x. Both investments were made under the VCT’s previous strategy. However, Tictrac is in line with the current strategy. Past performance is not a guide to the future.

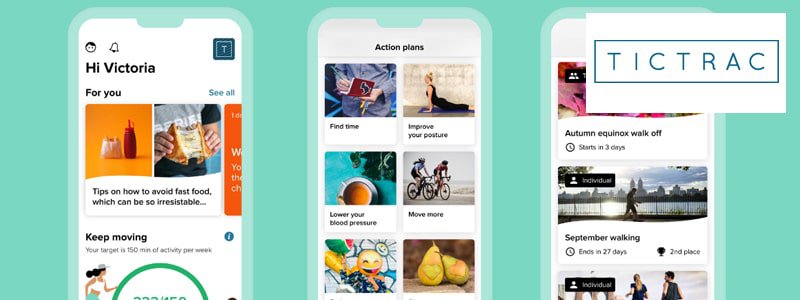

Tictrac – example of recent exit

Tictrac – example of recent exit

London-based Tictrac has created a platform used by businesses to provide health and wellbeing support to employees.

The platform uses data collected via wearable fitness trackers to give users personalised advice and action plans, designed to help them make better decisions on how to build and manage healthier behaviour.

Its primary customers are insurance companies, including some of the world’s largest, from Allianz to Prudential, and Aviva as well as thousands of employers and government health bodies.

In May 2022, the company was acquired by Canadian telemedicine firm Dialogue Health Technologies in a deal worth up to CA$56 million. The sale generated a 1.9x return for Puma VCT 13, based on an investment cost of £1.85 million. Past performance is not a guide to the future.

Performance and dividends

The VCT aims to pay average annual dividends of 5p per share, paid out of proceeds from investment sales. However, the dividend per share may vary considerably from year-to-year.

Following its exit from Pure Cremation in 2021, the VCT announced two interim dividend payments, collectively returning 11p per share to investors between December 2021 and March 2022. Following its exit from Tictrac in May 2022, the VCT paid a further 5.5p dividend in December 2022. The VCT did not declare a dividend in the most recent financial year. Please remember, dividends are variable and not guaranteed.

Over the five years to 31 March 2024, the VCT has generated a NAV total return (including dividends) of 56.7%. Note, we show VCT returns over a five-year period as a minimum, where possible. Where a VCT has followed the same investment strategy for longer, we also show returns over 10 years. Past performance is not a guide to the future.

NAV and cumulative dividends per share (p)

Source: Morningstar. The share class launched in 2017 and first allotted shares in 2018. Past performance is no guide to the future. Dividends are variable and not guaranteed. The bar chart shows net asset value and cumulative dividends per share for the period 31/12/2018 - 31/03/2024.

Dividends paid per calendar year

Source: Morningstar. Past performance is not a guide to the future. Dividends are not guaranteed. The graph shows the dividends paid per calendar year to 31/03/2024.

Dividend yield history (% of starting NAV)

| Calendar year | Dividend as % of NAV |

|---|---|

| 2019 | — |

| 2020 | — |

| 2021 | 5.8% |

| 2022 | 7.7% |

| 2023 | — |

| 2024 | — |

Source: Morningstar. Dividend yields are based on the dividends paid over the period divided by the starting NAV of the VCT in each period. Past performance is no guide to the future.

Dividend Reinvestment Scheme (DRIS)

The VCT intends to introduce a Dividend Reinvestment Scheme which would allow shareholders to reinvest future dividend payments by subscribing for new shares. As new shares, they should be eligible for tax relief (you will need to claim this on your tax return or directly with HMRC) and will count towards the VCT annual subscription limit.

Share buybacks

Once its portfolio has become more mature, the VCT intends to buy back shares at up to a 5% discount to the prevailing published net asset value. This is not guaranteed – please see the offer documents for details.

Discount history

VCT shares are traded on the London Stock Exchange. Similar to investment trusts, the share price can fluctuate and can be different from the VCT’s net asset value (NAV), i.e. the value of the VCT’s underlying investments. The difference between the share price of a VCT, and its net asset value per share, is called a discount.

Based on data from Morningstar, the discount to NAV as at 31 March 2024 was -1.59%. Over the previous five years the average discount to NAV was -10.6%.

The discount history is based on the closing share price of the VCT at the end of each month, divided by the latest net asset value at the time. Past performance is not a guide to the future. Investors looking to sell their VCT shares may get a better price using the VCTs’ share buyback facilities, although this is not guaranteed.

Risks: important

This, like all investments available through Wealth Club, is only for experienced investors happy to make their own investment decisions without advice.

VCTs are high-risk so should only form part of a balanced portfolio and you should not invest money you cannot afford to lose. They also tend to be illiquid and hard to sell and value. Before you invest, please carefully read the Risks and Commitments and the offer documents to ensure you fully understand the risks.

To retain the tax benefits, VCTs should be held for at least five years. If you sell VCT shares and reinvest in new shares of the same VCT (including any mergers) within six months, tax relief can be restricted. Tax rules can change and benefits depend on circumstances.

Charges and savings

A summary of the main charges and savings is shown below. The net initial charge shown includes the Wealth Club saving and any early bird discount. The investment may have additional charges and expenses: please see the provider documents including the Key Information Document for more details, offer price and share allotment calculation methodology.

Please note, capacity – for the offer or any early bird savings – can be reached early, and we may not be notified of this by the VCT in real time.

| Full initial charge | 3%* |

| Early bird discount | — |

| Wealth Club initial saving | 0% |

| Existing investor discount | 1% |

| Net initial charge through Wealth Club (new investors) | 3% |

| Net initial charge through Wealth Club (existing investors) | 2% |

| Annual management charge | 2% |

| Annual administration charge | 0.35% |

| Performance fee | 20% |

| Annual rebate from Wealth Club (for three years) | 0.10% |

*Puma also applies a charge of 0.35% as an effective contribution to the offer costs. This charge is deducted from investors' subscriptions.

More detail on the charges

Annual rebate when you invest through Wealth Club

The Puma VCT 13 includes an annual rebate for Wealth Club investors, payable for the first three years.

This is a rebate of our renewal commission and should be equivalent to a percentage (shown in the table above) of the Net Asset Value of the Offer Shares issued to you when you invest. Terms and conditions apply.

Deadlines

- Final closing date 5 July 2024 (5pm)

Our view

Puma is a well resourced investment house, with a long track record of investing in small and medium-sized businesses. The investment team focuses solely on scale-up opportunities, irrespective of sector – a superficially simple but potentially effective approach.

While the portfolio is split across multiple sectors, it is relatively small, with just 20 investments, and concentrated, with three holdings accounting for nearly a quarter of net assets.

Despite a busy year in terms of number of investments, the VCT continues to hold a significant amount of cash which should help diversify the portfolio in the coming years. The increased size of the VCT may help it attract and win competitive deals and add economies of scale to the trust, although this is not guaranteed.

To date, the trust has reported two exits, which have led to the payment of 16.5p per share in dividends, and several underlying holdings appear to show promise. Investors should note that while the VCT targets an average dividend of 5p per year, it has not declared any dividends in its most recent financial year. Past performance is not a guide to the future, dividends are variable and not guaranteed.

In our view, this is an up-and-coming VCT which may add diversification to an existing VCT portfolio.

How to invest

The most recent Puma VCT 13 share offer raised £47 million and closed in July 2024.

As soon as a new offer is announced, this page will be updated.

Please register your interest to receive free VCT alerts. You will be notified when a new offer opens.

Alternatively, view current VCT offers.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.

The details

- Type

- Generalist

- Target dividend

- -

- Initial charge

- -

- Initial saving via Wealth Club

- -

- Net initial charge

- -

- Annual rebate

- -

- Funds raised / sought

- £47.0 million / £50.0 million

- Deadline

- CLOSED