Charges test

Perhaps you have built up a portfolio of shares and funds over the years and wonder:

- How do all these investments, made at different times, fit together?

- Are they performing as well as they could?

- Are you taking enough risk, or coversely, not enough?

- Do you still have the time or inclination to manage your investments properly?

Perhaps you have built up a portfolio of shares and funds over the years and wonder:

- How do all these investments, made at different times, fit together?

- Are they performing as well as they could?

- Are you taking enough risk, or coversely, not enough?

- Do you still have the time or inclination to manage your investments properly?

----

----

A non breaking space using Option+spacebar on Mac

Break

Sortable tables

| Product | 3 Years | 5 Years | 10 Years |

|---|---|---|---|

| Albion Technology & General VCT | 19.00% | 55.30% | 84.20% |

| Kings Arms Yard VCT (Albion) | 35.00% | 55.80 | 154.70% |

| Albion Enterprise VCT | 23.70% | 61.90% | 149.40% |

| Albion VCT | 15.10% | 37.60% | 90.10% |

| Albion Development VCT | 29.80% | 66.90% | 132.40% |

| Crown Place VCT (Albion) | 23.80% | 59.90% | 132.50% |

| Baronsmead Second Venture Trust | 8.20% | 5.20% | 61.40% |

| Baronsmead Venture Trust | 5.90% | 2.40% | 63.90% |

| British Smaller Companies VCT | 49.00% | 70.60% | 149.20% |

| British Smaller Companies VCT2 | 46.10% | 63.50% | 102.40% |

| Foresight VCT | 33.60% | 44.60% | 50.20% |

| Foresight Enterprice VCT | 33.60% | 44.60% | 50.20% |

| Maven VCT | 10.00% | 20.10% | 67.00% |

| Maven VCT 3 | 13.00% | 14.10% | 62.90% |

| Maven VCT 4 | 8.80% | 22.80% | 43.70% |

| Maven VCT 5 | 16.10% | 24.60% | 112.80% |

| The Income & Growth VCT (Mobeus) | 48.50% | 73.90% | 165.00% |

| Mobeus Income & Growth VCT | 70.30% | 105.10% | 251.10% |

| Mobeus Income & Growth 2 VCT | 41.60% | 65.70% | 175.30% |

| Mobeus Income & Growth 4 VCT | 57.20% | 78.40% | 162.00% |

| Northern 2 VCT | 21.10% | 29.10% | 103.50% |

| Northern 3 VCT | 21.70% | 26.70% | 105.70% |

| Northern Venture Trust | 20.80% | 30.30% | 111.90% |

| Octopus Apollo VCT | 39.60% | 37.80% | 59.30% |

| Octopus Titan VCT | 23.20% | 33.10% | 152.20% |

| Pembroke VCT | 24.30% | 42.70% | - |

| ProVen VCT | 12.70% | 24.60% | 66.60% |

| ProVen Growth and Income VCT | 15.70% | 18.10% | 63.40% |

VCT

| 3 Years | 5 Years | 10 Years | ||

|---|---|---|---|---|

| Albion Technology & General VCT | 19.00% | 55.30% | 84.20% | |

| Kings Arms Yard VCT | 35.00% | 55.80 | 154.70% | |

| Albion Enterprise VCT | 23.70% | 61.90% | 149.40% | |

| Albion VCT | 15.10% | 37.60% | 90.10% | |

| Albion Development VCT | 29.80% | 66.90% | 132.40% | |

| Crown Place VCT | 23.80% | 59.90% | 132.50% | |

| Baronsmead Second Venture Trust | 8.20% | 5.20% | 61.40% | |

| Baronsmead Venture Trust | 5.90% | 2.40% | 63.90% | |

| British Smaller Companies VCT | 49.00% | 70.60% | 149.20% | |

| British Smaller Companies VCT2 | 46.10% | 63.50% | 102.40% | |

Foresight |

Foresight VCT | 33.60% | 44.60% | 50.20% |

| Foresight Enterprice VCT | 33.60% | 44.60% | 50.20% | |

| Maven VCT | 10.00% | 20.10% | 67.00% | |

| Maven VCT 3 | 13.00% | 14.10% | 62.90% | |

| Maven VCT 4 | 8.80% | 22.80% | 43.70% | |

| Maven VCT 5 | 16.10% | 24.60% | 112.80% | |

| The Income & Growth VCT | 48.50% | 73.90% | 165.00% | |

| Mobeus Income & Growth VCT | 70.30% | 105.10% | 251.10% | |

| Mobeus Income & Growth 2 VCT | 41.60% | 65.70% | 175.30% | |

| Mobeus Income & Growth 4 VCT | 57.20% | 78.40% | 162.00% | |

| Northern 2 VCT | 21.10% | 29.10% | 103.50% | |

| Northern 3 VCT | 21.70% | 26.70% | 105.70% | |

| Northern Venture Trust | 20.80% | 30.30% | 111.90% | |

| Octopus Apollo VCT | 39.60% | 37.80% | 59.30% | |

| Octopus Titan VCT | 23.20% | 33.10% | 152.20% | |

| Pembroke VCT B | 24.30% | 42.70% | - | |

| ProVen VCT | 12.70% | 24.60% | 66.60% | |

| ProVen Growth and Income VCT | 15.70% | 18.10% | 63.40% |

AIM VCT

| Provider | 3 Years | 5 Years | 10 Years |

|---|---|---|---|

| 13.50% | 12.80% | 131.60% | |

| 3.50% | 1.50% | 73.80% | |

| 5.40% | -5.00% | 69.30% | |

| 7.10% | -2.00% | 70.80% | |

| 18.10% | 21.00% | 146.60% |

“Investors tend to latch on to what can be measured, aided by the accountants and to some extent by their own laziness. But there is a wealth of information in items expensed by accountants, such as advertising, marketing and research and development, or in items auditors ignore entirely such as product integrity, product life cycles, market share and management character.”

| VCT | YTD | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|

| Albion Technology & Gen VCT | -1.3% | 23.3% | -3.0% | 11.5% | 15.0% | 6.2% |

| Kings Arms Yard VCT (Albion) | 2.6% | 17.2% | 3.2% | 1.9% | 11.9% | 4.2% |

| Albion Enterprise VCT | 0.5% | 22.6% | 1.2% | 4.5% | 21.7% | 9.3% |

| Albion VCT | 5.5% | 5.8% | 0.6% | 4.9% | 14.2% | 6.4% |

| Albion Development VCT | 1.3% | 21.5% | 3.1% | 4.0% | 20.8% | 11.1% |

| Crown Place VCT (Albion) | 1.9% | 19.1% | 0.9% | 13.2% | 10.9% | 8.7% |

| Baronsmead Second Venture Trust | -17.4% | 16.0% | 6.3% | 10.7% | -7.7% | 6.4% |

| Baronsmead Venture Trust | -17.2% | 14.2% | 5.7% | 6.2% | -4.7% | 9.3% |

| British Smaller Companies VCT | 1.8% | 32.3% | 5.5% | 8.5% | 8.9% | 2.7% |

| British Smaller Companies VCT2 | 0.4% | 27.4% | 7.3% | 5.6% | 7.3% | 3.7% |

| Foresight VCT | 4.7% | 27.9% | 1.4% | 4.2% | 3.6% | 6.6% |

| Foresight Enterprise VCT | 2.8% | 18.8% | 0.5% | 3.1% | 2.0% | -0.6% |

| Maven Income & Growth VCT | -1.4% | 11.1% | 0.7% | 6.8% | 1.6% | 2.4% |

| Maven Income & Growth VCT 3 | -3.0% | 15.5% | 0.8% | 0.7% | 0.2% | -0.3% |

| Maven Income & Growth VCT 4 | -3.1% | 12.4% | 3.9% | 1.6% | -1.3% | 3.1% |

| Maven Income & Growth VCT 5 | -0.5% | 13.5% | 2.1% | 0.9% | 8.5% | 11.2% |

| Maven Income & Growth VCT 6 | xxx% | 0.00% | 0.00% | -2.09% | -4.96% | -2.61% |

| The Income & Growth VCT | -15.9% | 43.5% | 23.0% | 12.8% | 2.6% | 6.9% |

| Mobeus Income & Growth VCT | -16.2% | 50.9% | 24.7% | 15.1% | 5.2% | 9.8% |

| Mobeus Income & Growth 2 VCT | -23.6% | 52.0% | 18.6% | 12.6% | -4.7% | 17.7% |

| Mobeus Income & Growth 4 VCT | -19.4% | 49.1% | 20.2% | 17.9% | 2.5% | 6.6% |

| Molten Ventures VCT | -9.3% | 35.8% | -7.5% | -2.5% | 2.7% | 0.5% |

| Northern Venture Trust | -12.0% | 16.4% | 14.1% | 5.4% | 3.2% | 5.0% |

| Northern 2 VCT | -8.6% | 17.5% | 10.0% | 4.5% | 3.1% | 2.3% |

| Northern 3 VCT | -8.8% | 18.7% | 8.3% | 6.5% | 1.6% | -0.2% |

| Octopus Apollo VCT | 3.0% | 26.0% | 10.5% | -3.8% | -0.9% | 3.9% |

| Octopus Titan VCT | -9.9% | 20.5% | 7.7% | 8.0% | 1.7% | 3.9% |

| Pembroke VCT | -0.5% | 19.7% | 3.8% | 2.6% | 14.0% | -2.6% |

| ProVen Growth & Income VCT | -2.1% | 20.2% | -1.0% | -7.4% | 11.2% | 4.3% |

| ProVen VCT | -1.7% | 13.2% | 2.4% | -6.9% | 20.0% | 2.5% |

| AIM VCTs | ||||||

| Amati AIM VCT | -26.6% | 1.9% | 37.2% | 20.5% | -14.5% | 48.1% |

| Hargreave Hale AIM VCT | -33.0% | 16.1% | 26.6% | 7.5% | -9.5% | 14.6% |

| Octopus AIM VCT | -30.0% | 8.5% | 23.4% | 11.3% | -10.4% | 14.4% |

| Octopus AIM VCT 2 | -29.4% | 8.8% | 24.2% | 12.7% | -10.3% | 13.2% |

| Unicorn AIM VCT Ord | -29.0% | 20.4% | 22.4% | 27.9% | -10.3% | 9.2% |

In brief: Capital Gains Deferral relief

How it works

If you realise a taxable gain, you could defer it by investing it into EIS. The CGT due shouldn’t be payable whilst the money remains invested, provided the EIS conditions are not breached.

| With EIS reliefs | Without EIS reliefs | |

|---|---|---|

| Taxable gain | £200,000 | £200,000 |

| 30% income tax relief | £60,000 | — |

| 28% CGT | Deferred | -£56,000 |

| Effective balance | £260,000 | £144,000 |

The table illustrates the difference an EIS investment could make for a higher or additional rate taxpayer with a £200,000 capital gain, if the gain is made from the sale of an investment property.

For this £200,000 capital gain, up to 28% CGT (£56,000) could be due. However, by investing all of the gain into EIS-qualifying shares, you could defer the CGT.

You could also claim up to 30% income tax relief on an EIS investment – potentially getting back £60,000, provided you have sufficient income tax liability in that tax year.

If and when the investment is realised, CGT at the prevailing rate would apply on the original £200,000. Alternatively, you could re-invest in EIS.

Note: you needn’t obtain EIS income tax relief to claim deferral relief on capital gains. However, you must obtain (and retain) income tax relief for any growth of your EIS investment itself not to incur CGT.

£1.25 MILLION

The average Wealth Club cheque size in the last 12 months

OVER 1,600

The number of people our companies employ in the UK and around the world

80%

The percentage of our companies that have attracted institutional capital

42% REVENUE GROWTH

The average company year-on-year revenue growth within Wealth Club led offers

£105.5 MILLION

Total invested to date across 61 EIS-qualifying companies:

- Current value £118.8m: 13% uplift

- 23% of companies have gone on to raise capital at a higher valuation

- 7% of companies have failed

RC Brown is a boutique investment management business with £330 million of assets under management, of which £33.3 million is held within the AIM IHT service.

The business was founded by Bob Brown, the current chairman, in 1990, and all members of the RC Brown team – directors, managers, and administrators – are equity shareholders or have equity options in the business.

The investment team is experienced and has an investment strategy focused on finding opportunities in the primary market, e.g. new share issues. It is an investment strategy the business has followed for 30 years through its other mandates, including the MFM UK Primary Opportunities Fund. It sets it apart from other AIM IHT portfolios, which may participate in – but do not have a focus on – primary opportunities.

- Portfolio of 30-40 AIM stocks

- Focus on primary market opportunities

- Minimum investment £50,000 - you can apply online

- Apply in an ISA: top up or make a new subscription online using the link below. To transfer existing ISAs, please download, print and complete the application form and post it to us

- Apply outside an ISA: please contact us for details

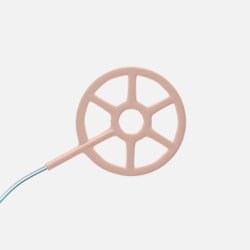

How the Natrox® technlogy works at a glance |

||

|

|

|

| The Oxygen Generator delivers continuous pure humidified oxygen to the wound bed through water electrolysis. | The device is supplied with two rechargeable batteries and a charging kit, so the user has freedom of movement. | The single-use Oxygen Delivery System connects directly to the Oxygen Generator. Its “web” like design optimises the flow of oxygen across the wound bed. |

AIM ISAs compared one against the other, if you hover over each line, you see which is which

IGNORE THIS – PREVIOUS TESTS

Charges and savings [VCT]

A summary of the main charges and savings is shown below. The net initial charge shown includes the Wealth Club saving and any early bird discount. The investment may have additional charges and expenses: please see the provider documents including the Key Information Document for more details. Test

[Note: if something is not available, e.g. early bird discount, we keep the row in and just put "–" instead of the value]

| Full initial charge | 5.5% |

| Early bird discount | — |

| Wealth Club initial saving | 2.5% |

| Existing shareholder discount | 1% |

| Net initial charge through Wealth Club (new investors) | 3% |

| Net initial charge through Wealth Club (existing shareholders) | 2% |

| Annual management charge | 2% |

| Annual administration charge | 0.3% |

| Performance fee | 20% |

| Annual rebate from Wealth Club (for three years) | 0.25% |

More detail on the charges

Charges and savings [EIS / SEIS fund]

A summary of the main charges and savings is shown below. Some of these will be payable by the investor, whilst others by the investee companies. The investment may have additional charges and expenses: please see the provider documents, including the Key Information Document, for more details.

[Note: if something is not available, e.g. early bird discount, we keep the row in and just put "–" instead of the value. Do not use 0%, nil, zero or N/A to represent an absent fee.]

| Investor charges | |

|---|---|

| Full initial charge | up to 0.75% |

| Wealth Club initial saving | — |

| Net initial charge through Wealth Club | up to 0.75% | Annual management charge | 1.05% |

| Administration charge | £150/month |

| Performance fee | 20% | Investee company charges |

| Initial charge | up to 0.75% |

| Annual charge | 1.05% |

More detail on the charges

Charges and savings [AIM IHT – inside and outside ISA]

A summary of the main charges and savings is shown below – The investment may have additional charges and expenses: Please see the provider documents for more details. If you would like a full breakdown or a personal illustration, please let us know.

| Full initial charge | 1% |

| Wealth Club initial saving | 0.25% |

| Net initial charge through Wealth Club | 0.75% |

| Annual management charge | 2% |

| Administration charge | 2% |

| Dealing fee | 1% |

| Performance fee | — |

| Exit fee | — |

See example of the total charges over 5 years

Charges and savings [IHT portfolios – non AIM]

A summary of the main charges and savings is shown below. Some of these will be payable by the investor, whilst others by the IHT companies and/or the underlying businesses. The investment may have additional charges and expenses: please see the provider documents for more details. If you would like a full breakdown or a personal illustration, please let us know.

[Note: if something is not available, e.g. early bird discount, we keep the row in and just put "–" instead of the value]

| Investor charges | |

|---|---|

| Initial charge | up to 0.75% |

| Annual management charge | 1.05% |

| Administration charge | £150/month |

| Performance fee | 20% | IHT company charges |

| Initial charge | up to 0.75% |

| Annual management charge | 1.05% |

| Administration charge | £150/month |

| Performance fee | 20% |

See example of the total charges over 5 years

What about insurance for IHT products?

I suggest that if a product offers optional insurance, we create an "Insurance" section just after the Risks section and before the Fees and Charges section.

Under the heading "Insurance" we will have:

- A brief description of the terms (what it covers, what options you have, etc.)

- A table showing the charges

- A note to the table stating the insurance charges are in addition to the standard fees and charges detailed below.

Chart test

Watch a video interview with Luke Finch, Partner at Hg Capital

WP Video embed test

Anchor podcast embed test

Spotify podcast embed test

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.