12 Wealth Club backed companies in Deloitte’s Fast 50 2023

Each year, the fastest-growing technology companies in the UK are ranked in Deloitte’s UK Technology Fast 50, based on the revenue in their last four full financial years.

This year’s recently announced winners range across fintech, clean energy, online marketplaces, health tech and more.

12 of them are companies in which Wealth Club members have invested via VCT, EIS or SEIS.

Read more and find out how to invest in these or similar companies. The companies below are ordered by ranking in the Fast 50, based on growth figures (as at May 2023) from the Deloitte report.

Read more on:

- Freetrade – Molten Ventures VCT

- Cera Care – Guinness EIS

- YuLife – MMC Ventures EIS Fund

- Veremark – Startup Funding Club SEIS / EIS, Triple Point Venture VCT

- OnBuy.com – Wealth Club direct investment and Fuel Ventures EIS funds

- MyTutor – Mobeus VCTs

- Warwick Acoustics — Mercia EIS Fund

- Rovco – Foresight Enterprise VCT

- Bramble Energy Ltd – Parkwalk Opportunities EIS Fund

- Deazy – Haatch Ventures Enterprise Investment Fund and Puma VCT 13

- YardLink – ProVen VCTs

- Cognism – Startup Funding Club SEIS and EIS funds

1. Freetrade — Molten Ventures VCT

Award-winning investing app Freetrade has achieved a 18,090% growth over its past four financial years, garnering it a ranking of 4th in this year’s Deloitte UK Technology Fast 50.

Award-winning investing app Freetrade has achieved a 18,090% growth over its past four financial years, garnering it a ranking of 4th in this year’s Deloitte UK Technology Fast 50.

The company is on a mission to make it easier and more affordable for people to get started investing. Its user-friendly app champions investor education and provides access to financial markets via a simple and transparent freemium pricing model.

Founded in 2017, Freetrade now has over 1.4 million users and c.£1.5 billion of assets under administration (August 2023).

How to invest in companies like Freetrade

Freetrade is part of Molten Ventures VCT’s current portfolio, so VCT shareholders – both existing and new – will get some exposure. The VCT is open and you can apply online.

2. Cera Care — Guinness EIS

Cera Care has featured in Deloitte’s UK Technology Fast 50 since 2020. The company is now ranked 7th, with 4,842% growth over the past four full financial years.

Cera Care has featured in Deloitte’s UK Technology Fast 50 since 2020. The company is now ranked 7th, with 4,842% growth over the past four full financial years.

Now Europe’s largest provider of digital-first home healthcare, Cera Care lets NHS and private patients book homecare, telehealth consultation and prescription services via its mobile app. The app can also collect and monitor client vital health signs in real time, enabling carers to respond rapidly and appropriately if needed.

Its founder Dr Ben Maruthappu, a former advisor to the NHS, set up the company in 2015 after experiencing the difficulties of arranging the right care for a loved one, and seeing how heavy administrative burdens can get in the way of care workers trying to provide quality care.

How to invest in companies like Cera Care

Cera Care was backed by Guinness Ventures. Experienced investors can get exposure to companies like Cera Care (albeit not Cera Care itself) by investing in the Guinness EIS fund.

3. YuLife — MMC Ventures EIS Fund

SME employee insurance platform YuLife grew 4,832% over its past four full financial years and is ranked 8th in the Deloitte UK Technology Fast 50 2023.

SME employee insurance platform YuLife grew 4,832% over its past four full financial years and is ranked 8th in the Deloitte UK Technology Fast 50 2023.

Founded in 2016, YuLife provides group insurance coverage for SME employees, an underserved sector.

The insurer’s gamified mobile app engages users with rewards for completing everyday wellness activities – to help build long-term healthy habits and decrease health risk. It also offers immediate access to mental health support, digital healthcare (Virtual GP) and wellbeing apps. With over 650k users across more than a thousand businesses globally, YuLife enjoys a 4.9/5 Trustpilot rating.

How to invest in companies like YuLife

YuLife was backed by MMC Ventures. Experienced investors will be able to get exposure to companies like YuLife (albeit not YuLife itself) by investing in the MMC Ventures EIS Fund. The fund is currently closed – you can register your interest online to receive an alert when it reopens.

4. Veremark — Startup Funding Club SEIS and EIS funds, Triple Point Venture VCT

Founded in 2019, HR technology developer Veremark has made its entry into the 2023 Deloitte UK Technology Fast 50 – ranked 9th – with a growth of 4,592% over the past four full financial years.

Founded in 2019, HR technology developer Veremark has made its entry into the 2023 Deloitte UK Technology Fast 50 – ranked 9th – with a growth of 4,592% over the past four full financial years.

Veremark develops blockchain software to help companies perform background-checks on potential employees quickly, reliably, compliantly and across borders – automating what has traditionally been a slow and costly manual process.

Clients include global brands such as Pepsico, McDonald’s and AXA. Veremark also partners with industry-leading platforms, including LinkedIn, to integrate seamlessly into a company’s existing HR and hiring tech.

How to invest in companies like Veremark

Veremark was backed by SFC Capital and Triple Point Ventures.

The company is part of Triple Point Venture VCT’s current portfolio, so VCT shareholders – both existing and new – will get some exposure. Triple Point Venture VCT is open and you can apply online.

Veremark was also backed by SFC Capital through its EIS and SEIS funds. Experienced investors can get exposure to companies like Veremark (albeit not Veremark itself) by investing in Startup Funding Club SEIS or Startup Funding Club Angel Fund EIS.

5. OnBuy — Wealth Club direct investment and Fuel Ventures EIS funds

Online marketplace OnBuy.com is in 11th place for the second year running in Deloitte’s UK Technology Fast 50, with 3,263% growth for its past four full financial years.

Online marketplace OnBuy.com is in 11th place for the second year running in Deloitte’s UK Technology Fast 50, with 3,263% growth for its past four full financial years.

OnBuy allows customers to buy new and used products online from different merchants, similarly to Amazon. Its point of difference is that it aims to deliver a fair marketplace by charging retailers lower fees, helping drive savings for customers. Unlike Amazon, OnBuy doesn’t compete with retailers, as it doesn’t sell any products of its own.

How to invest in companies like OnBuy

OnBuy.com was backed by Fuel Ventures through its EIS funds.

Wealth Club investors invested directly in OnBuy in 2021 – one of our single company investments.

Experienced investors can get exposure to companies like OnBuy (albeit potentially not OnBuy itself) by investing in Fuel Ventures’ EIS funds, or by investing in Wealth Club’s single-company EIS deals.

6. MyTutor — Mobeus VCTs

Tutoring platform MyTutor is ranked 21st in Deloitte’s UK Technology Fast 50 2023, having achieved 1,266% revenue growth for its past four full financial years.

Tutoring platform MyTutor is ranked 21st in Deloitte’s UK Technology Fast 50 2023, having achieved 1,266% revenue growth for its past four full financial years.

MyTutor helps connect (KS2 to sixth form) students with more affordable vetted tutors and provides the online space, interactive tools and tech support for one-to-one lessons.

Incorporated in 2013, the platform is a provider of the government-backed National Tutoring Programme, making tutoring more widely available to children across the UK.

How to invest in companies like MyTutor?

MyTutor is part of the Mobeus VCTs’ current portfolio, so existing shareholders will get some exposure. The Mobeus VCTs have confirmed they do not intend to fundraise in the current tax year. You can register your interest online to receive an alert when a new offer opens.

7. Warwick Acoustics — Mercia EIS Fund

Audio technology company Warwick Acoustics has achieved 1,167% growth for its past four full financial years, ranking in 24th place in Deloitte’s UK Technology Fast 50 2023.

Audio technology company Warwick Acoustics has achieved 1,167% growth for its past four full financial years, ranking in 24th place in Deloitte’s UK Technology Fast 50 2023.

Warwick Acoustics has created multi-award-winning headphone systems – and also the world’s first in-car ElectroAcoustic System, employing ultra-thin-and-light patented electrostatic transducer technology to deliver an outstandingly accurate sound reproduction and immersive experience.

Unlike conventional sound systems, Warwick’s sustainable technology uses no Rare Earth Elements (REEs) – responsible for generating toxic waste in a production process. As a significant amount of a car’s REE content may be found in its audio system, Warwick is working with several car manufacturers to switch to its high-quality alternative.

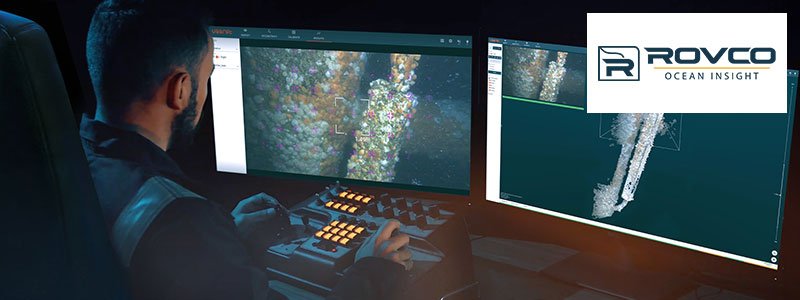

8. Rovco — Foresight Enterprise VCT

Subsea surveying and robotics company Rovco is ranked 32nd in the 2023 Deloitte UK Technology Fast 50, having grown revenue 891% over its past four full financial years.

Subsea surveying and robotics company Rovco is ranked 32nd in the 2023 Deloitte UK Technology Fast 50, having grown revenue 891% over its past four full financial years.

Founded in 2016, the Bristol-based company is a leading high-technology provider of marine site surveys, construction support, operations, maintenance and decommissioning to the offshore energy industry.

The company automates offshore wind services by creating, leveraging and deploying cutting-edge technology. Through the automation of hydrographic survey and ROV operations, it provide customers with better data quality and reporting, shorter projects, and a more competitive price.

How to invest in companies like Rovco?

Rovco is part of Foresight Enterprise VCT’s current portfolio, so VCT shareholders – both existing and new – will get some exposure.

Experienced investors can also get exposure to companies like Rovco (albeit not Rovco itself) by investing in Foresight WAE Technology EIS.

9. Bramble Energy Ltd — Parkwalk Opportunities EIS Fund

Clean energy fuel cell developer Bramble Energy ranks 39th in Deloitte’s UK Technology Fast 50 2023, with 811% growth for its past four full financial years.

Clean energy fuel cell developer Bramble Energy ranks 39th in Deloitte’s UK Technology Fast 50 2023, with 811% growth for its past four full financial years.

Bramble develops and manufactures simplified fuel cells that can integrate easily with customers’ existing technologies. Bramble uses existing printed-circuit-board production lines – and can thereby manufacture custom-made fuel cells anywhere in the world, in something like 30 days rather than the conventional 14-16 months.

The company is currently the lead partner, alongside the University of Bath and two other companies, in a government-funded multimillion landmark project to develop a hydrogen-powered double-decker bus using fuel cell technology.

How to invest in companies like Bramble Energy?

Bramble Energy was backed by Parwalk Advisors. Experienced investors can get exposure to companies like Bramble Energy (albeit not Bramble Energy itself) by investing in the Parkwalk Opportunities EIS Fund.

10. Deazy — Puma VCTs, Haatch EIS Fund

Freelance platform for software developers Deazy is listed for the second year running in the Deloitte UK Technology Fast 50. It ranks 40th with 753% growth in its past four full financial years.

Freelance platform for software developers Deazy is listed for the second year running in the Deloitte UK Technology Fast 50. It ranks 40th with 753% growth in its past four full financial years.

Deazy aims to provide businesses with a simple yet reliable way to find and hire vetted specialist software developers and teams from a global talent pool. This can be faster and more cost-effective than relying on expensive local agencies.

Founded in 2016, Deazy also helps its clients put teams together, brief and oversee projects. The platform currently hosts a pool of 6,000+ tech professionals, including 1,500+ pre-assembled dev teams, from across 24 countries.

How to invest in companies like Deazy

Deazy was backed by Puma Investments and Haatch Ventures.

The company is part of the current portfolio of both Puma Alpha VCT and Puma VCT 13, so shareholders of the two VCTs – existing and new – will get some exposure.

Experienced investors can also get exposure to companies like Deazy (albeit not Deazy itself) by investing in Haatch EIS Fund.

11. YardLink — ProVen VCTs

Online marketplace for renting construction equipment YardLink achieved 753% growth in its past four full financial years, and ranks 41st on Deloitte’s UK Technology Fast 50 2023.

Online marketplace for renting construction equipment YardLink achieved 753% growth in its past four full financial years, and ranks 41st on Deloitte’s UK Technology Fast 50 2023.

Founded in 2018, the Yardlink platform enables construction industry contractors to source, book and manage equipment, materials and services from a growing network of highly vetted suppliers – quickly and easily. The aim is to simplify and speed up procurement in one of the least digitised industries – the construction industry – where supply chain transactions still tend to be conducted by phone, email or pen and paper. This has the additional benefit of helping to reduce overheads and environmental footprint.

The company has worked with thousands of customers and projects – including Canary Wharf Contractors, HS2 and Battersea Power Station.

How to invest in companies like YardLink?

YardLink is part of the ProVen VCTs’ current portfolio, so existing shareholders will get some exposure. The ProVen VCTs have confirmed they intend to launch a new share offer in the current tax year. You can register your interest online to receive an alert when the offer opens.

12. Cognism — Startup Funding Club SEIS and EIS funds

Lead-generation software Cognism is at 43rd place in Deloitte’s Fast 50 with 633% growth over its past four full financial years.

Lead-generation software Cognism is at 43rd place in Deloitte’s Fast 50 with 633% growth over its past four full financial years.

Founded in 2015, Cognism has developed software that uses machine learning to help B2B companies identify valid sales prospects, gather contact information, and generate a timeline of their key company events.

Cognism estimates it helps sales and business development professionals have 7x more live leads and save time. As an instance, IT services company Ultima reports that Cognism enabled it to achieve its sales target with 70% fewer calls, seeing a return on investment within eight weeks.

How to invest in companies like Cognism

Cognism was backed by SFC Capital through both its SEIS and EIS funds. Experienced investors can get exposure to companies like Cognism (albeit not Cognism itself) by investing in Startup Funding Club SEIS or Startup Funding Club Angel Fund EIS.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.