VCTs raise £1 billion in 2022/23: the numbers…

Archived article

Archived article: please remember tax and investment rules and circumstances can change over time. This article reflects our views at the time of publication.

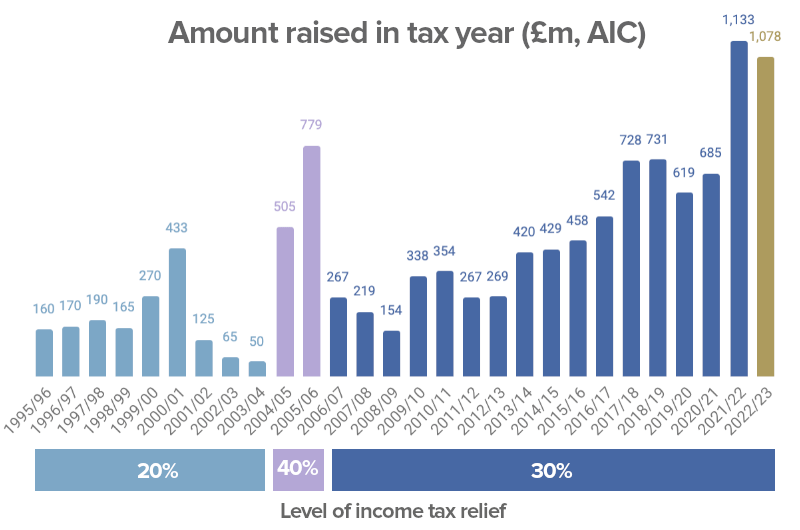

Funds raised by Venture Capital Trusts (VCTs) exceeded £1 billion for the second year running, according to AIC figures released today.

The AIC’s total – which includes dividend reinvestment – was £1.08 billion, the second highest year on record.

Despite the economic uncertainty, which contributed to a slower start to fundraising, the pace of VCT inflows increased towards tax year end. Twelve of the year‘s 27 offers closed before 5 April.

Despite the economic uncertainty, which contributed to a slower start to fundraising, the pace of VCT inflows increased towards tax year end. Twelve of the year‘s 27 offers closed before 5 April.

“Private investors have strongly supported Venture Capital Trusts again this year”, observes Will Fraser-Allen, managing partner of VCT manager Albion Capital. “It demonstrates the role VCTs play providing investors with investment exposure to young innovative UK companies.”

Malcolm Ferguson, partner at VCT manager Octopus Ventures, is not surprised by the popularity of the sector even amidst economic challenges. “The fundraising figures show how VCTs continue to be embedded into annual tax planning and investment strategy for retail investors with a higher risk appetite, even in the more turbulent economic times that we’ve seen over the last year.”

A slower start, a strong finish

Unlike the previous year, VCT fundraising in 2022/23 began tentatively. The first half of the tax year provided a backdrop of political and economic uncertainty. September’s “mini budget” and subsequent fallout led to the second change of Prime Minister and Chancellor of the Exchequer in a matter of months.

The pace of investment inflows picked up once several popular offers, including Mobeus VCTs and Octopus Titan VCT, opened in the autumn. Investors revealed a pent-up appetite for VCTs in the first quarter of 2023, as the total committed by investors ended up just 5% lower than the record set in 2021/22.

Play the animated chart to show the overall amount raised by VCT offers in 2022/23, compared to previous tax years:

During a tough year for investors, demand for VCTs remains near record levels demonstrating the numerous benefits they bring. VCTs have been around for over 25 years and are a trusted tax-efficient scheme.

Richard Stone, Chief Executive, AIC (Association of Investment Companies)

How much did each VCT offer raise?

Octopus Titan VCT set a new record fundraise of £237 million, exceeding its previous record of £231 million (2018/19). Altogether, manager Octopus Investments raised £364 million across its VCTs during the tax year (Titan, Apollo, Future Generations and Octopus AIM VCTs), including the continuation of the Octopus Apollo VCT and Future Generations VCT offers that opened the year before.

Seven VCT offers raised £50 million or more: Albion VCTs (£80m), Mobeus VCTs (£76m), British Smaller Companies (£75m), Baronsmead VCTs and Puma VCT 13 (both £50m).

Unicorn AIM VCT’s £15 million offer was the fastest fundraise, filling in just one day. This reflected supply as well as demand: altogether, AIM VCTs sought only half the amount they raised in 2021/22. Amati AIM VCT did not open a share offer, while Octopus AIM VCTs, Hargreave Hale and Unicorn raised £85 million altogether.

Guinness Ventures launched a brand new VCT, raising £4 million – the first new VCT since Blackfinch Spring in 2019, which in its fourth offer this year raised £6.6 million.

Play the chart to see how the offers that opened in 2022/23 progressed:

How does VCT fundraising help the economy?

The rise in popularity of Venture Capital Trusts is playing an increasingly important role in fuelling UK entrepreneurship. “This year’s fundraising follows the near £700m of investments into the UK’s small fast-growing businesses in 2022, which included an increase of more than 20% in unquoted investments to over £650 million”, says David Hall, managing director of YFM Equity Partners, which manages the British Smaller Companies VCTs. “It’s great to see this rising demand from small businesses matched by VCT investor appetite and reinforces the importance of the job that VCTs do in funding the next generation of UK businesses.”

Malcolm Ferguson, partner at Octopus Ventures, points out that VCT investment can provide a consistent lifeline to growth companies regardless of the direction of stock market sentiment. “It’s having this capital to support both existing growing companies and new high-potential companies, across all different market cycles, that has made the UK a strong place to start and scale a business. Through our VCTs, Octopus has been able to deploy around £150m in the last year to help power this growth and innovation in UK PLC.”

Last year VCTs invested £700 million in small private companies and AIM companies. This much-needed support to the UK’s fast-growing companies helps deliver vital economic, social and environmental advantages to the country.

Richard Stone, Chief Executive, AIC (Association of Investment Companies)

What is the outlook for VCTs in 2023/24?

Changes to tax rules taking effect from 6 April will affect many of the UK’s higher earners. The dividend and capital gains tax allowances are being cut to new lows, and 232,000 more people are forecast to be paying the top rate of income tax. For many wealthier investors there are limited options to invest tax efficiently. This means VCTs, although higher risk, are likely to remain popular with investors seeking exposure to smaller private companies.

Will Fraser-Allen of Albion Capital is positive on the outlook for VCTs: “Despite the ongoing global economic and geopolitical challenges, we believe that the opportunity for Venture Capital Trusts and their investors is significant. They play a pivotal role supporting entrepreneurs on their growth journey, resulting in positive economic and social benefits for the UK and valuable returns for patient VCT investors.”

Current VCT investment opportunities

Many offers have closed, but several VCTs remain open into 2023/24.

If you are an experienced investor comfortable with the risks and believe VCTs may be for you, there may be good reasons to consider investing at the start of the tax year. For example, you could potentially receive an extra year’s worth of dividends, which are variable and not guaranteed. The income tax relief could be paid to you during the year, rather than reclaimed afterwards via your tax return. Tax rules can change and tax benefits depend on circumstances.

Remember, the size and speed of a VCT’s fundraise does not necessarily indicate how well the investment will perform in the future. You should form your own considered view and read the offer documents carefully before investing. If unsure, seek advice.

Wealth Club aims to make it easier for experienced investors to find information on – and apply for – investments. You should base your investment decision on the offer documents and ensure you have read and fully understand them before investing. The information on this webpage is a marketing communication. It is not advice or a personal or research recommendation to buy any of the investments mentioned, nor does it include any opinion as to the present or future value or price of these investments. It does not satisfy legal requirements promoting investment research independence and is thus not subject to prohibitions on dealing ahead of its dissemination.